If you’re a doula in California, you know the heart and soul that goes into supporting birthing people and their families. But let’s be honest, while the work is rewarding, it should also be sustainable. One of the most common questions we hear from doulas is: How do I get paid for my services, especially through insurance?

Good news: California is leading the way when it comes to doula reimbursement through Medi-Cal, the state’s Medicaid program. In this blog, we’ll break down everything you need to know about billing as a doula in California, including Medi-Cal coverage, private insurance tips, and the best billing support options available.

Is Doula Care Covered by Insurance in California?

Yes, especially if your client has Medi-Cal. As of January 1, 2023, California began covering doula services under Medi-Cal. This change is part of a broader effort to reduce maternal health disparities and improve birth outcomes across the state.

However, private insurance coverage is still hit or miss. Some clients may be able to use HSA/FSA funds, and a few insurers might reimburse for out-of-network doula services, but more on that later.

What Does Medi-Cal Cover for Doulas?

If you’re an enrolled Medi-Cal doula provider, you can bill for:

- Up to 3 prenatal visits

- Labor and delivery support

- Up to 4 postpartum visits

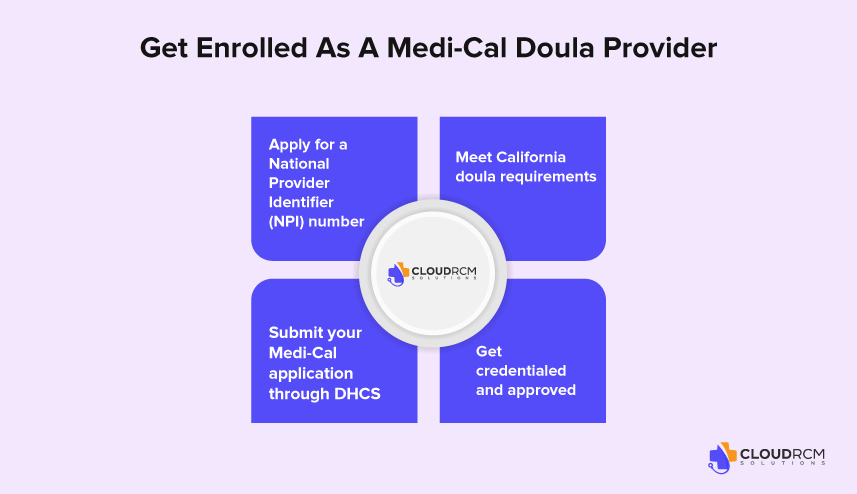

How to Get Enrolled as a Medi-Cal Doula Provider

To bill Medi-Cal and receive Medi-Cal doula reimbursement rates, you must first become an official Medi-Cal doula provider. Here’s a more detailed look at how to get started:

Apply for a National Provider Identifier (NPI) number

All doula providers must have an NPI number to bill Medi-Cal. You can apply online through the National Plan and Provider Enumeration System (NPPES). This is a key part of identifying yourself as a legitimate healthcare provider.

Meet California doula requirements

The California doula requirements include completing an approved doula training program, passing a background check, and demonstrating experience supporting birthing people. Many doulas meet these requirements through well-known programs like DONA International, but California also recognizes community-based and culturally responsive training programs.

Submit your Medi-Cal application through DHCS

Once you’ve met the requirements, you’ll need to apply through the Department of Health Care Services (DHCS). This involves submitting documentation to show you meet all the Medi-Cal doula requirements, including training certificates and proof of your NPI. The DHCS website provides a downloadable enrollment application specifically for doulas.

Get credentialed and approved

After DHCS reviews your application, you’ll be notified of your enrollment status. Once approved, you’ll be officially listed as a Medi-Cal doula provider and can begin billing for eligible services at the state’s Medi-Cal doula reimbursement rates.

Medi-Cal Doula Reimbursement Rates California (Effective 2024)

| Service | Description | Rate |

| Initial Intake Visit | Up to 90 minutes | $197.98 |

| Prenatal Visit | Per visit (up to 3) | $162.11 |

| Postpartum Visit | Per visit (up to 4) | $162.11 |

| Extended Postpartum Visit | Up to 3 hours | $486.36 |

| Labor Support – Vaginal Birth | One-time billing | $685.07 |

| Labor Support – Cesarean Birth | One-time billing | $795.73 |

| Miscarriage Support | One-time billing | $250.85 |

| Abortion Support | One-time billing | $250.48 |

Estimated Total Reimbursement per Client

| Birth Type | Estimated Total |

| Vaginal Birth | ~$3,150 |

| Cesarean Birth | ~$3,260 |

How Much Can Doulas Earn Through Medi-Cal Billing in California?

Once you’re enrolled and credentialed as a Medi-Cal doula provider, you’re eligible to bill for a variety of covered services. California offers some of the most competitive Medicaid rates in the country for doula care.

Here’s a breakdown of what you can bill Medi-Cal for:

- Initial intake visit (up to 90 minutes): $197.98

- Prenatal and postpartum visits: $162.11 per visit (multiple visits allowed)

- Extended postpartum visit (up to 3 hours): $486.36

- Labor support:

- Vaginal birth: $685.07

- Cesarean birth: $795.73

- Support during miscarriage or abortion: Approximately $250 per event

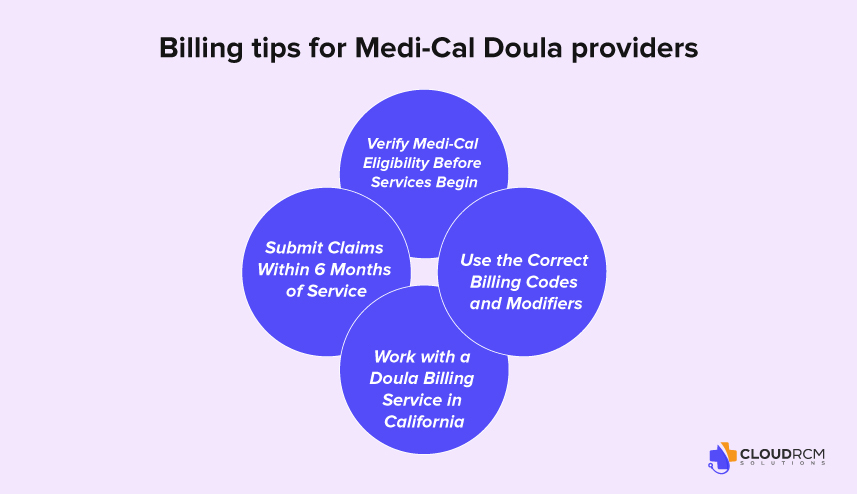

Doula Billing Tips: Avoiding Denials and Getting Paid Faster

Getting reimbursed through Medi-Cal can be smooth, but only if your billing process is tight. Here are some proven tips to help California doulas avoid delays, denials, and missed payments:

Verify Medi-Cal Eligibility Before Services Begin

Before your first visit, confirm that your client is actively enrolled in Medi-Cal and check whether they’re part of a Fee-for-Service (FFS) plan or a Managed Care Plan (MCP) (like LA Care or Anthem Blue Cross). This determines how and where you’ll submit claims. You can verify eligibility through the Medi-Cal Eligibility Verification System (EVS) or ask your billing partner to assist.

Submit Claims Within 6 Months of Service

The Medi-Cal claims deadline is strict: you must submit your claim within six months from the date of service. Late claims are often denied with little room for appeal. To avoid timing issues, submit your documentation within 1–2 weeks of each visit.

Use the Correct Billing Codes and Modifiers

DHCS has specific HCPCS and CPT codes assigned to doula services in California. Using the wrong code or omitting a required modifier can lead to immediate rejection. Here are a few commonly used codes:

- S9445 – Doula support, per session

- T1027 – Family training and counseling

- T2043 – Maternity case management

- T1001 – Initial intake assessment

Make sure you’re using the correct codes for the service and the client’s plan type (FFS or MCP). If you’re unsure, refer to the DHCS Doula Provider FAQ or consult with a medical billing professional.

Work with a Doula Billing Service in California

If the paperwork feels overwhelming, you’re not alone. Many doulas partner with a medical billing service that specializes in California doula reimbursement. A good billing partner like CloudRCM can help with:

- Verifying client eligibility

- Submitting accurate claims

- Tracking reimbursements

- Avoiding costly errors

How to Document Doula Services for Billing in California

Accurate and consistent documentation is a key part of successful billing, especially when you’re working with Medi-Cal. Good charting not only protects you in the case of an audit, but also ensures that you’re meeting California doula billing standards. Let’s walk through how to document your services clearly and efficiently.

What to Include in Doula Progress Notes

Every time you provide a service, whether it’s a prenatal visit, labor support, or postpartum care, you should complete a doula progress note with these key elements:

- Client name and Medi-Cal ID

- Date and time of service

- Location (in-person, virtual, home, hospital)

- Service type (e.g., Prenatal Visit #2)

- Duration of session (Start/End time or total minutes)

- Topics discussed or activities performed (e.g., birth plan review, breathing techniques, emotional support)

- Client’s response or outcome (e.g., “Client reports reduced anxiety about delivery”)

- Doula’s name and NPI number

- Client signature (if required by DHCS plan type)

What to Do If Your Medi-Cal Doula Claim Is Denied

Even experienced doulas can run into billing issues. If your Medi-Cal doula claim is denied, don’t panic; most denials are fixable with the right steps.

Common Reasons Your Claim Might Be Denied

- Client was ineligible on the date of service (not enrolled in Medi-Cal or wrong plan type)

- Wrong billing code or modifier used

- Missing documentation, like progress notes or NPI number

- The claim submitted after the 6-month deadline

How to Fix or Appeal a Denied Medi-Cal Doula Claim

If your claim is denied, follow these steps to resolve the issue quickly and get paid.

Identify the Problem

Check your Remittance Advice (RA) or provider portal to find the denial code and reason.

Correct the Error

Common fixes include:

- Updating the billing code or modifier

- Attaching missing documentation (e.g., doula chart notes, NPI)

- Correcting client eligibility info

Resubmit the Claim

Once fixed, resubmit through the correct system:

- Fee-for-Service (FFS): Use Medi-Cal’s online system or paper claims

- Managed Care Plan (MCP): Use the appropriate MCO’s provider portal

File an Appeal (if needed)

Still denied? File a formal appeal with supporting documents:

- For FFS claims, use the DHCS 90-1 appeal form

- For MCP claims, visit the managed care plan’s website for their appeal process and deadlines

How to get a doula through Medicaid?

To find a doula covered by Medicaid:

- Call Your MCO: Ask if doula services are included in your plan and request a list of approved providers.

- Visit Your State’s Medicaid Website: Look for doula coverage info and provider directories.

- Check for Fee-for-Service Options: Some states allow you to choose any Medicaid-enrolled doula.

- Use Doula Directories: State or city websites (e.g., NYC.gov) may list Medicaid-accepting doulas.

- Know the Requirements: Coverage may depend on certification or provider enrollment with Medicaid or MCOs.

- Explore Alternatives: Some local programs offer free or low-cost doula care even if Medicaid doesn’t.

Example: NY and CA both offer doula services through Medicaid with provider directories online.

Where can I find a Medicaid-covered doula?

The easiest way to get a doula covered by Medicaid is to contact your Medicaid Managed Care Organization (MCO). Your MCO can connect you with an available doula and explain the types of support doulas offer.

Here are the participating MCOs you can reach out to for doula services:

- Aetna Better Health

- CareFirst BlueCross Blue Shield Community Health Plan Maryland

- Jai Medical Systems

- Kaiser Permanente

- Maryland Physicians Care

- MedStar Family Choice

- Priority Partners

- UnitedHealthcare

- Wellpoint (formerly Amerigroup)

Final Thought

Being a doula in California means making a powerful impact, but your work deserves financial sustainability too. With Medi-Cal now covering doula care, there’s a real opportunity to turn your passion into a viable profession. The process may feel overwhelming, but with the right guidance, training, and billing support, you can get paid for the care you provide accurately and on time.

Whether you’re just starting out or already enrolled as a Medi-Cal doula provider, CloudRCM is here to help you deal with the billing process with confidence. Because when your claims get paid, your energy stays where it belongs with your clients.

How CloudRCM Helps Doulas Get Paid Without the Headaches

Billing Medi-Cal can be complex, but you don’t have to do it alone. CloudRCM is a California-based medical billing service that helps doulas stay compliant with DHCS requirements, submit accurate claims, and get reimbursed faster. We handle the paperwork, coding, and follow-ups so you can focus on your clients, not chasing payments.

Ready to streamline your billing? Schedule an appointment with our team today!

FAQs:

How long does it take to get approved by DHCS?

Approval can take several weeks to a few months, depending on application completeness and processing time.

Can I bill for services before I’m enrolled?

No, you must be fully enrolled and approved by DHCS before billing for any services.

Do I need malpractice insurance to become a Medi-Cal doula?

It’s not required by DHCS, but some Managed Care Plans may request it.

Can I bill for virtual visits?

Yes, Medi-Cal allows billing for eligible doula services provided via telehealth.

Is training through DONA enough for Medi-Cal enrollment?

Yes, DONA is one of the approved training programs recognized by California.

Does Medicaid cover doulas in North Carolina?

No, NC Medicaid doesn’t currently reimburse doulas directly. However, some managed care plans like Healthy Blue may offer doula coverage as a value-added benefit in select counties.

Medical Billing

Medical Billing Medical Coding

Medical Coding Medical Audit

Medical Audit Provider Credentialing

Provider Credentialing Denial Management

Denial Management A/R Follow-up

A/R Follow-up Private Practice

Private Practice Patient Help Desk

Patient Help Desk Customized Reporting

Customized Reporting Out-of-Network Billing

Out-of-Network Billing Internal Medicine

Internal Medicine Pediatrics

Pediatrics Radiology

Radiology Surgery

Surgery Emergency Medicine

Emergency Medicine Anesthesiology

Anesthesiology Cardiology

Cardiology Orthopedic

Orthopedic Psychiatry

Psychiatry Dentistry

Dentistry OB-GYN

OB-GYN Family Medicine

Family Medicine