Manual insurance eligibility verification is one of the top causes of claim denials, accounting for nearly one in four rejected claims. As administrative burdens rise, providers are losing valuable time and revenue to outdated verification workflows.

AI-driven insurance verification is changing the game, helping healthcare providers reduce denials, automate eligibility checks in real time, and speed up revenue cycles, all while improving patient satisfaction and front-office efficiency.

What Is Insurance Eligibility Verification?

Insurance eligibility verification is the process of confirming a patient’s active coverage and benefits with their health insurance provider before delivering medical services. It ensures that the provider will be reimbursed and that the patient understands their financial responsibility upfront.

In traditional workflows, eligibility checks are done manually, usually by phone or through payer portals, making it a slow, error-prone task that often leads to claim denials, especially when information is outdated or incorrect.

The Problem with Manual Insurance Verification

Manual insurance verification is one of the biggest bottlenecks in healthcare operations today. It’s time-consuming, error-prone, and costly, both for providers and patients.

Time-Consuming & Inefficient

Front-office teams often spend hours on the phone with insurance companies or jumping between payer portals to verify patient benefits. The average staff member spends over 12 minutes per verification call. Now multiply that by dozens of patients per day, and you’ve got a serious productivity drain.

Prone to Human Error

Manual data entry opens the door to costly mistakes that can derail the revenue cycle. Even the most experienced staff can miskey numbers or overlook critical changes in coverage.

Common errors include:

- Incorrect policy numbers that mismatch payer records

- Missed plan updates due to outdated insurance cards or recent employer changes

- Misread coverage details, such as copay amounts or authorization requirements

Delays, Denials & Dissatisfied Patients

When insurance eligibility isn’t confirmed accurately and in real time, both the provider and patient are left vulnerable. Without clear coverage details at the time of service, several issues arise:

- Appointments get rescheduled or canceled, especially when coverage can’t be confirmed at check-in

- Patients face surprise bills they weren’t expecting, damaging trust in your practice

- Claims are denied or delayed due to inactive insurance, missing referrals, or out-of-network coverage

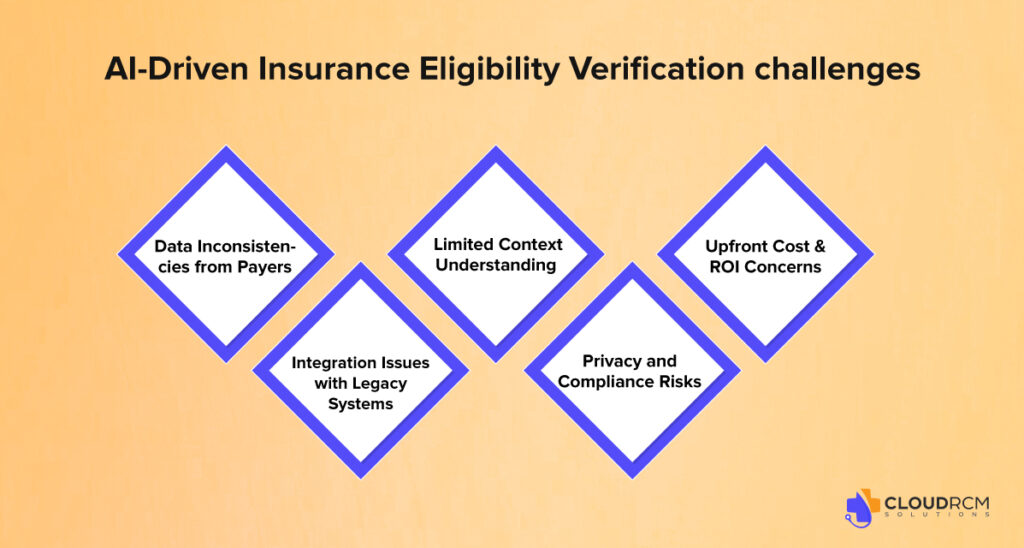

Challenges of AI-Driven Insurance Eligibility Verification in Healthcare

While AI brings speed and accuracy to insurance verification, it’s not without limitations. Understanding these challenges helps providers make smarter technology choices.

Data Inconsistencies from Payers

AI tools rely on up-to-date data from insurance carriers, but payer systems aren’t always standardized, which can lead to mismatches or delays.

Integration Issues with Legacy Systems

Older EHR or practice management systems may not integrate smoothly with AI tools, requiring costly customizations or IT support.

Limited Context Understanding

AI may misinterpret nuanced cases (e.g., secondary coverage, COB, or non-standard benefit plans) without human validation.

Privacy and Compliance Risks

Although HIPAA-compliant, AI tools still require careful vetting to ensure data privacy, especially when working with third-party vendors.

Upfront Cost & ROI Concerns

Smaller practices may find initial investment or subscription costs challenging, especially without a clear short-term ROI.

Benefits of AI-Driven Insurance Eligibility Verification in Healthcare

In the healthcare industry, AI is transforming the way providers handle insurance eligibility, the most critical yet traditional manual steps in Revenue cycle management.

Real-Time Insurance Eligibility Checks

AI platforms connect directly with payer databases and clearinghouses to provide instant eligibility status. This eliminates the need for phone calls, manual portal checks, or faxed responses. Real-time verification ensures staff can confirm benefits, deductibles, copays, and authorization requirements before the patient even arrives.

Reduction in Claim Denials

Insurance-related errors are a leading cause of denied or delayed claims. AI tools automatically verify coverage details and flag inconsistencies, helping providers catch issues like inactive policies, missing referrals, or coordination of benefits problems before claim submission. This significantly reduces denials tied to eligibility.

Time and Labor Savings

Front-office staff often spend 10–15 minutes verifying a single patient’s insurance manually. AI-driven systems automate this process, allowing staff to verify multiple patients simultaneously. This improves productivity, reduces burnout, and frees up teams to focus on higher-value tasks like patient communication or scheduling.

Faster Revenue Cycle and Clean Claims

With eligibility confirmed upfront, fewer claims are rejected on the back end. This leads to faster claim approvals, fewer reworks, and quicker payments from insurers. Practices using AI for eligibility checks often report higher first-pass claim acceptance rates and a more predictable cash flow.

Consistent and Scalable Processes

AI tools operate 24/7, enabling practices to verify insurance in batches or in real-time, regardless of volume. This scalability is especially useful for larger practices or groups managing multiple providers, locations, or specialties. As patient volume increases, AI-driven tools can handle the growth without adding headcount.

Improved Patient Satisfaction

When patients know their benefits and out-of-pocket costs before treatment, it reduces confusion, surprise bills, and financial stress. AI makes it easier to provide patients with accurate estimates at check-in, leading to a smoother visit and a better overall experience.

Enhanced Accuracy and Compliance

AI tools are designed to pull verified payer data, reducing the risk of manual input errors. They also log verification details and timestamps, which helps maintain audit-ready documentation and supports compliance with HIPAA and payer documentation standards.

Top Tools for Insurance Eligibility Verification

Here are some of the top tools used by healthcare providers and billing professionals to verify insurance eligibility efficiently:

- Availity Essentials – Free, multi-payer access (e.g., BCBS, Aetna)

- ZirMed (Waystar) – Better RCM platform with real-time eligibility

- Navinet – Direct connectivity with large health plans

- Practice Management Systems – Built-in tools in software like Athenahealth, Kareo, and AdvancedMD

- Change Healthcare – Enterprise-level clearinghouse with eligibility checks

- Office Ally – Budget-friendly option for small practices

- Experian Health – High-volume, hospital-friendly solution

- Trizetto (Cognizant) – Clearinghouse with full RCM features

- Direct Payer Portals – e.g., Medicare DDE, Aetna, UHC

Final Thought

Manual insurance checks slow you down and cost you money. AI-driven verification helps you catch errors early, speed up payments, and improve patient experiences. It’s a smarter, faster way to manage your revenue cycle, and CloudRCM can help you get there.

Need a Smarter Way to Verify Insurance?

Tired of spending hours on the phone with insurance companies or dealing with surprise denials later? At CloudRCM, we help healthcare practices like yours transition to AI-powered insurance verification, saving time and reducing stress. If you’re curious how much smoother your front office could run, schedule a free billing workflow audit today. No hard sell just real insights into where you might be losing time and revenue.

FAQs

How does AI improve insurance verification in healthcare?

AI automates eligibility checks in real-time, reducing manual errors and streamlining patient intake and claims processing.

What tools or software are used for AI-based eligibility checks?

AI tools like clearinghouses, RCM platforms, and EHR-integrated APIs connect directly with insurers for instant verification.

Is real-time eligibility verification HIPAA-compliant?

Yes, trusted AI systems are HIPAA-compliant and use encrypted data to protect patient information.

What are the benefits of automating insurance verification?

Automation reduces denials, saves staff time, improves accuracy, and speeds up the revenue cycle.

Is AI reliable enough for healthcare administrative tasks?

Yes, AI handles repetitive verification tasks with high accuracy and consistency.

Medical Billing

Medical Billing Medical Coding

Medical Coding Medical Audit

Medical Audit Provider Credentialing

Provider Credentialing Denial Management

Denial Management A/R Follow-up

A/R Follow-up Private Practice

Private Practice Patient Help Desk

Patient Help Desk Customized Reporting

Customized Reporting Out-of-Network Billing

Out-of-Network Billing Internal Medicine

Internal Medicine Pediatrics

Pediatrics Radiology

Radiology Surgery

Surgery Emergency Medicine

Emergency Medicine Anesthesiology

Anesthesiology Cardiology

Cardiology Orthopedic

Orthopedic Psychiatry

Psychiatry Dentistry

Dentistry OB-GYN

OB-GYN Family Medicine

Family Medicine