In medical billing and Revenue Cycle Management (RCM), comprehending and managing insurance eligibility verification is equivocally important to streamline your financial workflow. However, you may have already discovered that this process entails quite a number of challenges.

In this blog, we will discover the top challenges of insurance eligibility and later discover the possible solutions which can help you to overcome them.

Moreover, simplify patient registration with our insurance eligibility verification services. Our comprehensive solutions verify eligibility, deductibles, and copays, helping you focus on patient care.

Before we explore the challenges, let us first understand how insurance eligibility plays an important part in healthcare services.

Insurance eligibility plays an integral role in healthcare services, acting as a gateway for optimized financial workflow. It helps you determine whether the services rendered will be covered by the patient’s insurance, thereby directly influencing your revenue cycle.

Moreover, get expert insights on massage therapy billing best practices with our Massage Therapy Insurance guide. Our comprehensive guide covers complex coding and billing requirements, reducing claim denials and ensuring accurate reimbursement. Simplify your medical billing processes with our guidance.

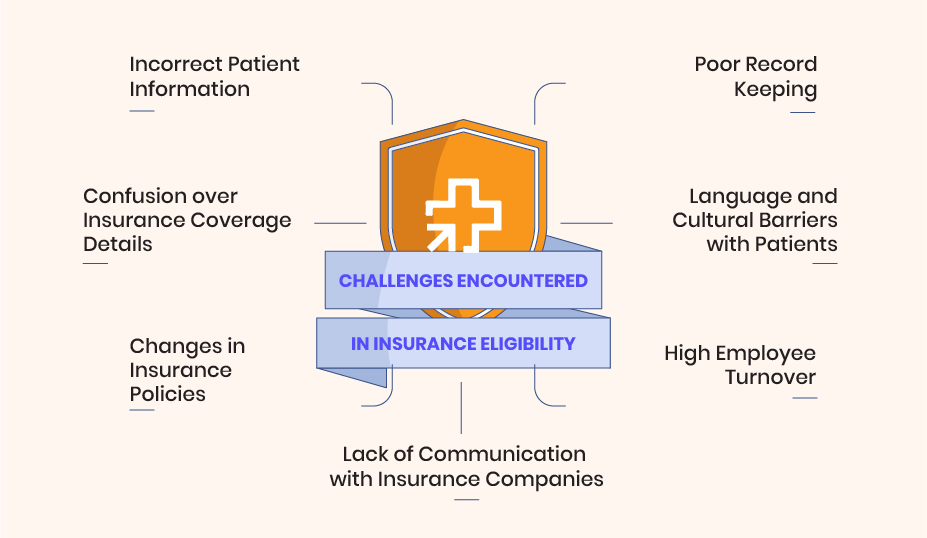

Without any further due, let us discover the top and common challenges healthcare providers face when they opt for insurance eligibility. By fully comprehending these challenges, you will be better equipped to identify the problems and come up with the much needed solutions.

Incorrect patient information is a frequent issue in insurance eligibility verification that can create significant difficulties in your healthcare operations. This problem arises when details like patient names, birth dates, or insurance policy numbers are incorrectly entered or updated. Simple errors like these can lead to claim denials, causing disruptions in your revenue cycle..

If unresolved, the issue of incorrect patient information can compound over time, leading to more systematic problems. The volume of denied claims can increase, causing revenue losses and delays in reimbursement. For the patient, this might result in unexpected out-of-pocket expenses, causing financial strain and dissatisfaction with your services.

It’s crucial to recognize the importance of accurate patient information in insurance eligibility verification, not only for smooth operations but also for maintaining strong patient relationships.

The confusion over insurance coverage details is a prevalent challenge that you may face in insurance eligibility verification. The myriad of insurance policies, each with different coverage rules and exceptions, can be perplexing. This lack of clarity can result in services being performed that aren’t covered by the insurance, leading to financial losses for your healthcare organization.

The time and effort required to interpret and understand complex insurance policy details can also create a significant administrative burden. This complexity often results in misinterpretation of coverage rules, leading to claim denials or adjustments. Such situations can disrupt your revenue cycle and may negatively affect the relationship with your patients.

The fluid nature of insurance policies, with constant updates in coverage, deductibles, and out-of-pocket maximums, can make it difficult for you to stay current. Failure to account for these changes can lead to inaccurate eligibility verification, causing unforeseen denials and adjustments, which negatively impact your revenue.

The constant flux in insurance policies not only creates administrative hurdles but also poses a risk to the efficiency of your billing operations. It requires continuous monitoring and training, adding to your operational costs and complexity. Moreover, it increases the likelihood of errors, which can lead to claim denials or rejections.

This issue often manifests as disorganized or incomplete patient data, and missing or incorrectly stored insurance details. These shortcomings can lead to inaccurate eligibility checks, resulting in claim denials or rejections, and disrupt your revenue cycle.

Poor record keeping can lead to inaccuracies in billing, resulting in unexpected out-of-pocket expenses for patients. This can lead to patient dissatisfaction, which can harm the reputation and patient retention rates of the healthcare provider. Moreover, inefficient record keeping can require additional labor and time to rectify mistakes, leading to increased operational costs.

Language and cultural barriers with patients can present a substantial challenge for you when verifying insurance eligibility in healthcare. Often, these barriers can lead to miscommunication or misunderstanding of important information related to insurance coverage. As a result, you may face difficulties in accurately determining eligibility.

Language or cultural barriers can also affect your relationship with patients. For patients who are not proficient in the language used by your healthcare organization, or who have different cultural perspectives, the process can seem intimidating or confusing. This situation can result in their reluctance to share crucial information, making your task of verifying insurance eligibility even more challenging.

High employee turnover is a notable challenge that you may face when managing insurance eligibility in healthcare. Losing experienced staff can disrupt your operations as replacements might lack the necessary knowledge or experience to efficiently handle insurance eligibility verification. This gap can lead to mistakes in the verification process, resulting in claim denials or rejections, and potentially affecting your revenue cycle.

Continual high employee turnover can result in chronic inaccuracies in insurance eligibility verification, leading to delayed reimbursements. For your patients, this could mean facing unexpected out-of-pocket costs due to these inaccuracies and experiencing inconsistent service. Consequently, it’s crucial for you to address this challenge and aim for staff retention to ensure efficient and accurate insurance eligibility verification.

A lack of communication with insurance companies is a significant challenge that can affect your ability to accurately verify insurance eligibility in healthcare. Information from insurance companies is vital to understanding the specifics of a patient’s coverage, but insufficient communication can leave you in the dark. This can lead to misunderstandings about coverage specifics, resulting in denied claims and potentially impacting your revenue cycle.

A persistent lack of communication with insurance companies can lead to ongoing inaccuracies in insurance eligibility verification, resulting in delayed payments and reimbursements. Therefore, fostering efficient communication with insurance companies is crucial to ensure accurate insurance eligibility verification and to maintain a smooth revenue cycle.

Now that you are aware of the challenges, you may ponder on how to overcome them using effective strategies. Whether it is investing in

or enhancing staff training, there are a number of strategies that can help you tackle the difficulties associated with insurance eligibility.

Let us explore the top strategies that can help you overcome the aforementioned challenges in insurance eligibility.

Leveraging technology and automation can significantly streamline your insurance eligibility verification process. With automated systems, you can reduce human error, speed up the process, and easily keep up with changes in patient insurance policies. Moreover, using technology allows for real-time verification, ensuring the most up-to-date insurance information is used when making decisions about patient care.

If you want to maintain accuracy in insurance eligibility, providing regular training and education to your staff is of paramount importance. By equipping your staff with updated knowledge about changing insurance policies and procedures, you can reduce inaccuracies and improve the efficiency of your verification process. In addition, well-trained staff are better able to manage challenging situations and patient queries, improving your healthcare organization’s overall service quality.

Conducting regular audits and quality checks can help you maintain a high standard of accuracy in insurance eligibility verification. Through these checks, you can identify patterns of errors or areas of inefficiency, allowing you to address issues proactively and prevent future mistakes. Regular audits not only contribute to better operational efficiency but also help improve the financial health of your organization by reducing claim denials and rejections.

Another effective strategy is to standardize all the procedures that undergo within your healthcare business. When you have consistent procedures, it will help in reducing errors, improve productivity and make certain that all staff members are on the same page. Also, well-defined processes make it easier to train new staff, ensuring a smoother transition and reducing the impact of employee turnover.

Exploring the challenges of insurance eligibility may be a complex aspect but it is quite critical for healthcare services. When you have entirely comprehended these services, it marks the first step to developing effective strategies to mitigate these challenges. Using our aforementioned strategies, you can easily improve your insurance eligibility verification and enhance the overall healthcare experience.

As a comprehensive solution to these challenges, Cloud RCM provides top-tier insurance eligibility services. Utilized advanced technology, we offer real-time insurance eligibility verification, reducing human error and speeding up the process. With Cloud RCM, healthcare providers can efficiently navigate insurance eligibility hurdles, streamline their revenue cycle management, and deliver the best patient care.

Revenue Cycle Management (RCM), the method for handling healthcare claims adjudication, is the revenue generator for