In California’s complex healthcare billing landscape, a returned Medi-Cal claim can significantly disrupt a practice’s cash flow. One of the most common forms causing delays is the Medi-Cal RTD (Resubmission Turnaround Document). For many billing teams, these forms appear with minimal explanation, leaving staff scrambling to decipher errors, correct data, and resubmit claims often resulting in weeks of delayed payments.

However, a Medi-Cal RTD form isn’t a denial. With a structured understanding and response strategy, it becomes an opportunity to correct claims efficiently and secure reimbursement faster. This 2026 guide provides California healthcare providers and medical billers with actionable insights to prevent, respond to, and resolve Medi-Cal RTD forms without compromising cash flow.

What Is a Medi-Cal RTD Form?

The Resubmission Turnaround Document (RTD) is issued by the California Department of Health Care Services (DHCS) whenever a claim contains missing, incomplete, or invalid information. Unlike a denial, an RTD is not a rejection it is a request to correct and resubmit the claim within a specified timeframe.

When providers receive an RTD, the DHCS message is clear:

“We couldn’t process this claim as submitted. Please review, correct, and return within 35 days.”

Failing to respond within the 35-day window results in the claim being automatically voided, which delays reimbursement and disrupts practice revenue cycles.

Key Components of an RTD Form Include:

- Control Number: Links the RTD to the original claim.

- Error Codes: Identify the reason for the return.

- Correction Fields: Space for notes and corrections.

Skilled billers and California medical billing services review RTDs carefully, identify errors, attach required documentation, and resubmit claims to ensure fast processing.

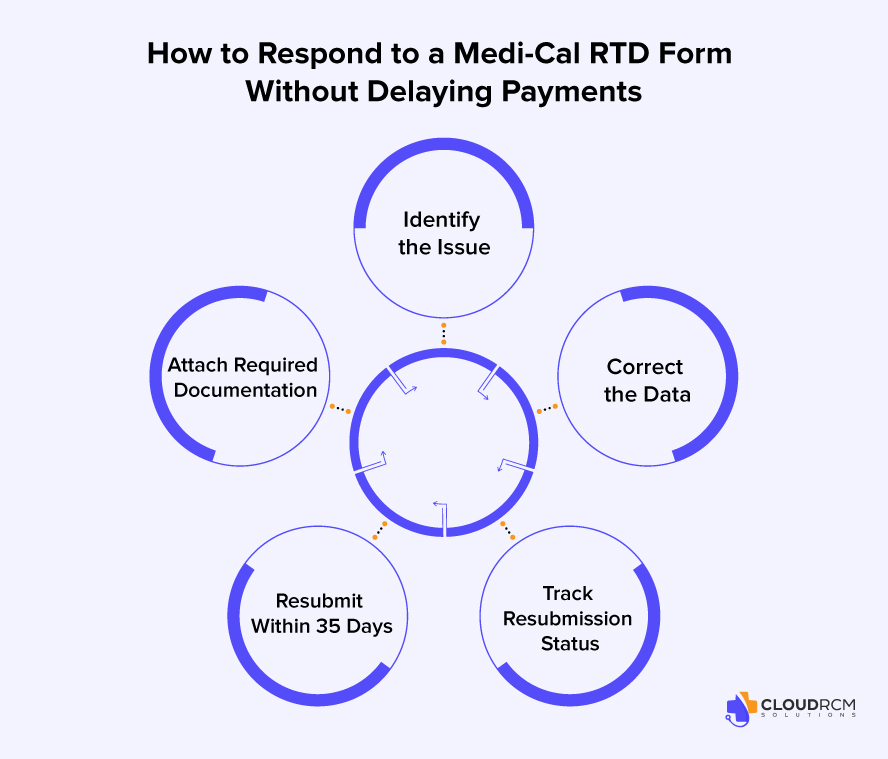

How to Respond to a Medi-Cal RTD Form Without Delaying Payments

Timely and accurate response to an RTD determines whether a claim is paid on schedule or pushed further into aging accounts receivable. A 5-step workflow can streamline RTD management:

Here’s a simple 5-step response workflow every Medi-Cal biller should follow:

- Identify the Issue:

Review the RTD error code and reason. It tells you exactly what’s missing or incorrect (e.g., wrong NPI, patient ID, or date of service). - Correct the Data:

Fix errors directly on the RTD or in your billing software. Verify all demographic, coding, and provider information. - Attach Required Documentation:

If the RTD references a missing authorization, operative report, or attachment, include it with your resubmission. - Resubmit Within 35 Days:

Mail or electronically send the corrected claim and RTD to DHCS before the deadline. Waiting until the last day increases rejection risk. - Track Resubmission Status:

Use your clearinghouse or internal tracking log to ensure the corrected claim is received, accepted, and posted for payment.

By following this structured workflow, practices can avoid Medi-Cal payment delays and ensure billing compliance.

RTD vs. Denial: Understanding the Difference

It’s essential to distinguish between an RTD and a claim denial:

| Aspect | RTD (Resubmission Turnaround Document) | Denial |

| Purpose | Request for correction or missing info | Full rejection after adjudication |

| Action Required | Correct and return within 35 days | File an appeal or corrected claim |

| Opportunity to Fix | Yes — same claim can be resubmitted | Limited, must appeal or rebill |

| Payment Impact | Temporary delay | Possible permanent loss |

| Typical Cause | Data or documentation errors | Eligibility, coverage, or medical necessity issues |

Understanding this difference is key. An RTD is not a loss; it’s a fixable opportunity. Denials, however, require more time and appeal effort.

Common Reasons Medi-Cal Claims Generate RTDs and How to Avoid Them

Based on Medi-Cal’s 2025–2026 billing performance reports, nearly 1 in 5 returned claims were due to preventable administrative errors. Common triggers include:

- Missing or invalid rendering provider NPI or taxonomy

- Incorrect patient ID or eligibility information

- Mismatched service dates or procedure codes

- Missing authorization numbers or attachments

- Outdated or incorrect ICD-10/CPT codes

- Wrong place of service

- Billing under incorrect provider or facility ID

Prevention Tip: Implementing a pre-submission audit step in your billing workflow can reduce RTDs by up to 90%.

Top 10 Tips for Handling Medi-Cal RTD Forms Effectively

- Verify patient eligibility before claim submission.

- Double-check billing and rendering NPIs.

- Keep copies of all RTDs and corrected claims.

- Always reference the original RTD number when resubmitting.

- Use claim tracking software to monitor resolution timelines.

- Don’t wait, resubmit within 25 days, not day 34.

- Train your team on reading Medi-Cal error codes accurately.

- Document all corrections in billing notes.

- Review monthly RTD trend reports to catch recurring issues.

- Partner with an experienced Medi-Cal billing service for oversight and compliance.

Why Proper RTD Management Matters in 2026

Even a single unresolved RTD can trigger thousands in delayed payments. In 2025, DHCS reported that over $150 million in Medi-Cal payments were delayed due to unreturned RTDs. For small and medium-sized practices, these delays can jeopardize financial stability and disrupt operations.

Timely tracking, structured resubmission, and proactive audits ensure claims are corrected and payments are received efficiently.

Preventing RTD Errors That Cost Thousands

| Error Type | Impact | Prevention Strategy |

|---|---|---|

| Missing documentation | Claim voided | Attach prior authorizations and operative reports upfront |

| Invalid codes | Payment rejection | Use certified coding validation tools |

| Wrong NPI or TIN | Provider mismatch | Keep CAQH and DHCS info updated |

| Late submission | Claim closed | Set 25-day resubmission reminders |

| Incomplete correction | Processing delay | Double-check RTD reason codes before resubmitting |

Even small administrative errors can lead to large financial losses. Routine audits, automation, and staff training are essential for risk reduction.

The Hidden Cost of Ignoring Medi-Cal RTD Forms

Unworked RTDs directly translate into lost revenue. For example, a clinic submitting 200 Medi-Cal claims weekly could lose over $30,000 annually in delayed reimbursements if RTDs are not processed promptly.

Delays also reduce recovery chances. The longer an RTD sits unresolved, the harder it becomes to secure full payment, emphasizing the importance of timely response and tracking.

How CloudRCM Reduces Medi-Cal RTDs with Clean Claim Submission Practices

At CloudRCM Solutions, we help California practices simplify the Medi-Cal billing process from claim creation to payment posting, using advanced technology and expert insight.

Our specialized RTD reduction strategy includes:

- Pre-submission audits to catch missing or invalid data

- AI-based validation of CPT, ICD-10, and modifier accuracy

- Eligibility and NPI verification to eliminate mismatches

- Automated RTD alerts for faster tracking and follow-ups

- Dedicated Medi-Cal billing experts familiar with DHCS compliance rules

By combining automation with human expertise, we’ve helped practices cut RTD-related payment delays by 40% and improve clean claim rates dramatically.

If your billing team is drowning in RTD follow-ups, CloudRCM can streamline your workflow and keep your revenue cycle healthy.

Final Thoughts

Medi-Cal RTD forms in 2026 are not a barrier, they are a recoverable opportunity. With the right understanding, workflow, and preventive measures, healthcare providers can ensure claims are corrected efficiently, avoid payment delays, and sustain stable cash flow.

By adopting structured RTD management, performing pre-submission audits, and leveraging California-focused billing expertise, practices can reduce errors, improve reimbursement speed, and focus on delivering quality patient care.

What is a Medi-Cal RTD form used for?

It’s a Resubmission Turnaround Document sent by Medi-Cal when a claim needs correction or clarification before payment.

How long do I have to respond to a Medi-Cal RTD form?

You must return the corrected RTD within 35 days, or the claim will be voided.

How can I avoid Medi-Cal RTD payment delays?

Ensure accurate data entry, verify eligibility, and partner with an experienced RCM service for proactive monitoring.

What’s the difference between an RTD and a denial?

An RTD allows correction and resubmission; a denial means the claim has been fully rejected.

Can CloudRCM help manage Medi-Cal RTDs?

Absolutely. Our team tracks, corrects, and submits Medi-Cal claims to reduce RTDs and accelerate reimbursements.

Medical Billing

Medical Billing Medical Coding

Medical Coding Medical Audit

Medical Audit Provider Credentialing

Provider Credentialing Denial Management

Denial Management A/R Follow-up

A/R Follow-up Private Practice

Private Practice Patient Help Desk

Patient Help Desk Customized Reporting

Customized Reporting Out-of-Network Billing

Out-of-Network Billing Internal Medicine

Internal Medicine Pediatrics

Pediatrics Radiology

Radiology Surgery

Surgery Emergency Medicine

Emergency Medicine Anesthesiology

Anesthesiology Cardiology

Cardiology Orthopedic

Orthopedic Psychiatry

Psychiatry Dentistry

Dentistry OB-GYN

OB-GYN Family Medicine

Family Medicine