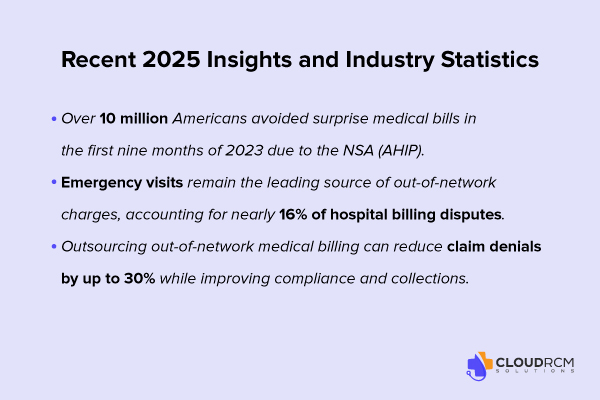

Surprise bills are out, compliance is in. Under the No Surprises Act, out-of-network billing for most emergency and hospital-based services must follow strict federal billing laws, limiting charges to a patient’s in-network cost share. Since 2022, this rule has prevented more than 10 million surprise medical bills, holding out-of-network providers and hospitals accountable for balance billing violations.

From anesthesia to ambulance billing, staying compliant with out-of-network billing rules isn’t optional — it’s essential.

Understanding the No Surprises Act (NSA)

The No Surprises Act (NSA) is a federal law that protects patients from surprise billing and balance billing for out-of-network emergency care and certain out-of-network services at in-network hospitals, such as anesthesia out of network, radiology, or ambulance out of network. Under the law, patients are only responsible for their in-network cost-sharing, like copays, coinsurance or deductibles.

For providers, this means out-of-network medical billing, out-of-network hospital bills, and other out-of-network charges must follow strict out-of-network billing laws, and any disputes are resolved without burdening the patient.

This includes services such as:

- Anesthesia out of network

- Radiology and pathology services

- Ambulance and transport services

The NSA ensures that out-of-network billing services are fair, transparent, and legally compliant, removing unexpected costs for patients.

What Is Out-of-Network ER Billing?

Out-of-network ER billing can lead to unexpected costs for patients and challenges for providers. Here’s what it means and how the No Surprises Act addresses it.

Definition and Context

Out-of-network ER billing occurs when a patient receives care from an emergency physician or at a hospital that isn’t contracted with their insurance network. Traditionally, this led to balance billing, where the patient was responsible for the difference between the provider’s charge and the insurer’s payment.

Thanks to the No Surprises Act and provisions from the Affordable Care Act, patients are now protected from most surprise billing situations. They are only responsible for their in-network cost-sharing (copays, coinsurance, or deductibles).

This law ensures that out-of-network emergency care and hospital billing are fair, transparent, and compliant giving patients peace of mind while allowing providers to manage their billing properly.

Impact on Patients

Before the NSA, patients could face thousands of dollars in out-of-network hospital bills after an emergency visit, even at in-network facilities. Now, under the act, patients are only responsible for in-network cost-sharing (copays, coinsurance, and deductibles).

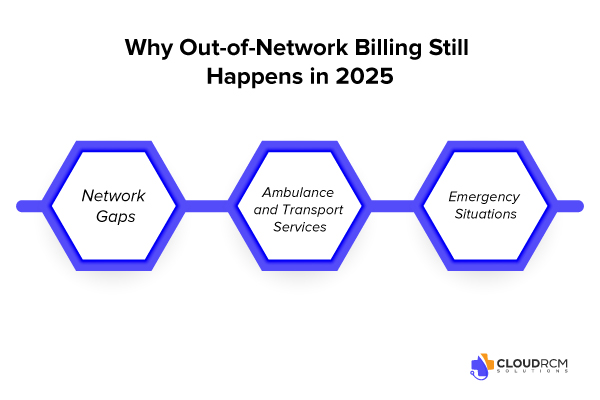

Why Out-of-Network Billing Still Happens in 2025

Out-of-network billing can happen unexpectedly, leaving patients and providers facing surprise charges. Here are some common ways this occurs and why out-of-network ER billing continues to be a challenge.

Network Gaps

Not every provider within a hospital is part of an insurance network. For example, an anesthesiologist working in an in-network hospital may be out of network. Radiologists, pathologists, and surgical assistants may bill separately from the hospital, resulting in out-of-network charges.

Ambulance and Transport Services

Many patients arrive at the ER via ambulance out-of-network, which can trigger out-of-network ambulance bills that patients are not prepared for.

Emergency Situations

Patients typically cannot choose their provider during emergencies, so ER doctors out of network may deliver care, which would traditionally lead to surprise medical billing charges.

Key Challenges for Providers Under the No Surprises Act

Managing out-of-network ER billing comes with several challenges for healthcare providers. Here are some of the key hurdles they face and ways these issues impact both billing and patient care.

Compliance with Out-of-Network Billing Laws

Providers must adhere strictly to OON billing rules under the NSA. Non-compliance can result in fines, disputes, and potential reputational damage.

Payment Disputes

Out-of-network providers may face disputes with insurers over reimbursements. The Independent Dispute Resolution (IDR) process can be lengthy and complex.

Administrative Burden

Managing out-of-network ER billing, producing good faith estimates, and tracking out-of-network hospital charges adds administrative complexity. Many providers rely on out-of-network billing services or specialized out-of-network billers to manage this workload.

Patient Communication

Patients often misunderstand their rights under the NSA, which can lead to complaints or disputes over balance billed charges.

Variability in Charges

Different providers in the same facility may charge vastly different rates, making out-of-network anesthesia billing and other ancillary service billing difficult to reconcile with insurance payments.

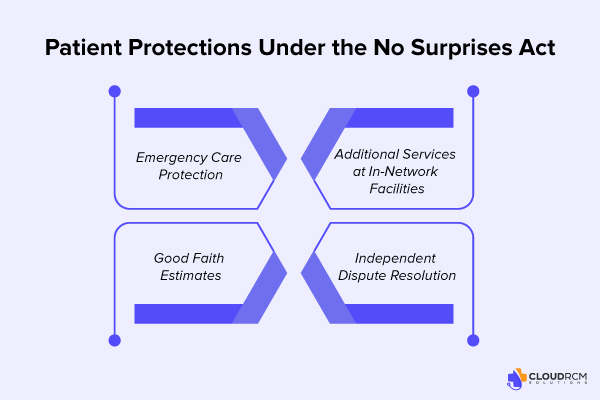

How the NSA Protects Patients from Surprise Medical Bills

The No Surprises Act provides several key protections to shield patients from unexpected out-of-network costs:

Emergency Care Protection

Patients receiving out-of-network emergency care pay only their in-network cost-sharing — even if the hospital or physician is out of network.

Additional Services at In-Network Facilities

Services like anesthesia, radiology, and surgical assistance are protected from balance billing unless the patient provides informed consent.

Good Faith Estimates

For uninsured or self-pay patients, providers must issue a good-faith estimate of expected charges. If the final bill exceeds this by $400 or more, patients can dispute it.

Independent Dispute Resolution (IDR)

The IDR process resolves payment disagreements between providers and insurers, preventing patients from being caught in the middle.

Best Practices for Providers Managing OON ER Billing

Effectively managing OON ER billing requires proactive strategies to remain compliant and reduce administrative burden.

Verify Insurance and Network Status

Confirm whether providers and facilities are in-network before care is provided, whenever possible.

Transparent Billing Practices

Communicate billing policies clearly and provide detailed invoices to enhance patient understanding and satisfaction.

Patient Consent for Non-Emergency Services

Obtain written consent before providing out-of-network services at in-network hospitals, particularly for ancillary services like anesthesia or radiology.

Utilize Professional Billing Services

Outsourcing to specialized billing companies ensures accurate claims, faster reimbursements, and full compliance with out-of-network billing regulations.

Stay Updated on Regulations

Regularly review updates to NSA rules, reimbursement changes, and IDR processes to remain compliant.

Why Choose CloudRCM for Out-of-Network Billing Services

Partnering with a professional medical billing service simplifies out-of-network ER billing and ensures full compliance with the No Surprises Act.

- Expertise in Compliance: Our billing specialists ensure your practice adheres to all out-of-network billing laws.

- Efficient Revenue Cycle Management: We minimize payment delays, reduce disputes, and maximize reimbursement.

- Improved Patient Satisfaction: By preventing surprise bills, our process builds trust and strengthens provider–patient relationships.

State-by-State Overview: Out-of-Network ER Billing Laws & Compliance (2025)

| State | Law / Regulation | Key Provisions | Provider Insight |

|---|---|---|---|

| Texas | Texas Balance Billing Protection Act (aligned with NSA) | Prohibits emergency physicians, anesthesiologists, and hospital-based providers from billing beyond in-network cost-sharing. The Texas Department of Insurance (TDI) manages mediation and dispute resolution alongside the federal Independent Dispute Resolution (IDR) process. | ER groups in Texas should document all payer communications, maintain accurate QPA benchmarking data, and file disputes promptly to ensure fair payment outcomes. |

| California | AB-72: Emergency Room Billing Compliance Law | Applies to both ER and hospital-based providers. Out-of-network clinicians (e.g., anesthesiologists, pathologists, radiologists) cannot balance bill patients treated at in-network facilities. The Department of Managed Health Care (DMHC) enforces compliance and penalties. | Billing services in California must ensure all NSA notices, cost-sharing disclosures, and consent forms comply with federal and DMHC standards to avoid penalties and ensure timely reimbursement. |

| Florida | Balance Billing Protection Act (SB 1442) | Aligns with the NSA and adds protections for air and ground ambulance services — frequent sources of billing disputes. The Office of Insurance Regulation (OIR) oversees enforcement and complaint resolution. | ER and ambulance billing providers in Florida should monitor payer denials, maintain accurate cost-sharing documentation, and ensure strong IDR case files. |

| New York | Emergency Medical Services and Surprise Bills Law | Predates the NSA but operates in parallel. The Department of Financial Services (DFS) manages arbitration for out-of-network payment disputes between insurers and providers. | ER providers in New York must determine whether disputes fall under state or federal IDR and maintain evidence of fair market payment rates. |

| Illinois | Network Adequacy and Transparency Act | Ensures adequate access to in-network emergency care. Requires payers to maintain transparent provider directories. Works in coordination with NSA billing standards. | Illinois-based providers should verify payer network listings and use validated data to dispute any claims of “network insufficiency.” |

| Michigan | No Surprises Act Enforcement – DIFS Oversight | The Department of Insurance and Financial Services (DIFS) enforces the federal NSA and prohibits billing beyond in-network cost-sharing for emergency or ancillary out-of-network services. | Providers in Michigan should ensure staff comply with NSA documentation standards and DIFS filing deadlines when disputing underpaid out-of-network claims. |

Why Local Compliance Matters for Providers

Although the No Surprises Act provides a federal framework, state laws define how disputes are processed, which agencies oversee enforcement, and how payers must respond.

For multi-state healthcare organizations, hospitals, and emergency physician groups, aligning billing workflows with both state and federal out-of-network billing laws helps to:

- Avoid costly penalties and compliance risks

- Accelerate claim resolutions

- Strengthen payer negotiation positions

- Protect patients from balance billing violations

Final thought:

The No Surprises Act has transformed out-of-network ER billing, protecting patients from balance billing and unexpected hospital charges. However, it has also created new compliance and administrative challenges for healthcare providers.

By verifying insurance, obtaining patient consent, leveraging professional billing support, and staying up to date with regulations, providers can manage these challenges efficiently. Partnering with an experienced out-of-network billing company ensures compliance, maximizes revenue, and builds patient trust.

Partner with CloudRCM for Multi-State Compliance

Streamline your Out-of-Network Billing Services and ensure full compliance with federal and state laws while maximizing reimbursements. Our experts handle end-to-end processes—from claim submission and payer dispute resolution to IDR filing and documentation review—so every claim is accurate, compliant, and fully reimbursed. Strengthen your compliance strategy and optimize OON ER billing across all 50 states by contacting CloudRCM today to schedule your appointment.

FAQs

What does out-of-network mean in medical billing?

In medical billing, “out-of-network” means the provider or facility doesn’t have a contract with the patient’s insurance company. This often leads to higher charges or balance billing unless protected under the No Surprises Act.

What happens if I see a doctor outside of my network?

Seeing an out-of-network doctor can result in higher bills since your insurance may cover less. However, under the NSA, patients are protected from most unexpected out-of-network emergency and ancillary care charges.

What’s the difference between in-network and out-of-network?

In-network providers agree to discounted rates with insurers, keeping costs lower for patients. Out-of-network providers do not have such agreements, often resulting in higher out-of-pocket expenses.

What is an out-of-network deductible?

An out-of-network deductible is the amount a patient must pay before insurance contributes toward out-of-network medical bills. It’s typically higher than the in-network deductible.

What is the difference between in-network and out-of-network providers?

In-network providers have contracts with insurance companies to accept negotiated rates. Out-of-network providers do not, which can lead to balance billing and higher patient costs.

Medical Billing

Medical Billing Medical Coding

Medical Coding Medical Audit

Medical Audit Provider Credentialing

Provider Credentialing Denial Management

Denial Management A/R Follow-up

A/R Follow-up Private Practice

Private Practice Patient Help Desk

Patient Help Desk Customized Reporting

Customized Reporting Out-of-Network Billing

Out-of-Network Billing Internal Medicine

Internal Medicine Pediatrics

Pediatrics Radiology

Radiology Surgery

Surgery Emergency Medicine

Emergency Medicine Anesthesiology

Anesthesiology Cardiology

Cardiology Orthopedic

Orthopedic Psychiatry

Psychiatry Dentistry

Dentistry OB-GYN

OB-GYN Family Medicine

Family Medicine