If you’ve ever wondered why a $220 office visit turns into a $96 insurer payment and a $24 patient responsibility, the answer lives in one phrase: the allowed amount. Mastering how allowed amounts are set and how they flow through claims, EOBs, and contracts is one of the fastest ways to protect margins, reduce denials, and set better patient expectations.

You’ll see how allowed amounts differ by payer (Medicare, Medicaid, commercial), what changes in 2025 matter, how to calculate patient portions in real-world specialties, and exactly how to audit and improve your workflows.

What “Allowed Amount” Really Means?

The allowed amount is the maximum a health plan will pay for a covered service. You’ll also hear “negotiated rate,” “eligible expense,” or “payment allowance.” That ceiling is not your billed charge; it drives both the payer’s payment and the patient’s cost-sharing.

Why you should care:

- Patient out-of-pocket (copay/coinsurance/deductible) is calculated off the allowed, not your charge.

- Your contractual write-off is essentially a charge allowed for in-network claims.

- For out-of-network (OON) services, plans often base payments on the UCR or a plan-defined allowed amount; in many cases, the balance can be billed to the patient, unless prohibited (e.g., in certain scenarios under the No Surprises Act).

How Allowed Amounts Affect Reimbursements and Patient Costs

The allowed amount is more than just a payer number; it directly impacts how much you collect from both insurance and patients. For providers, here’s why it matters:

- Reimbursements depend on it: Even if you bill $400 for a service, if the allowed amount is $250, that’s the ceiling. Insurance will never pay above that number.

- Patient costs are tied to it: Copays, coinsurance, and deductibles are always calculated on the allowed amount, not your billed charge.

- Contracts shape your revenue: In-network agreements require you to adjust off (write off) the difference between your charge and the allowed amount. Out-of-network claims may allow balance billing, but new rules like the No Surprises Act restrict this in certain situations.

- Denials and underpayments often start here: If the wrong allowed amount is applied, your claim may be short-paid or denied entirely. A 2024 MGMA survey found that 60% of practices saw rising denials, many tied to eligibility and contract issues.

How Payers Decide the Allowed Amount

Every payer uses its own rules to decide how much it’ll reimburse for a medical service. This is why the same CPT code may pay differently under Medicare, Medicaid, or a commercial plan. Understanding these differences is critical for accurate patient estimates and cleaner claims.

Medicare:

Allowed amounts are determined by the Medicare Physician Fee Schedule (PFS), calculated as RVUs × conversion factor × geographic adjustment (GPCI). Medicare updates the fee schedule annually, so allowed amounts may shift each year.

For example, a CPT code like 99213 (established office visit) may have a base rate of $92 nationally, but adjustments for practice expense and location can raise or lower that figure.

Medicaid:

Each state sets its own Medicaid fee schedule, and rates are typically lower than Medicare and commercial plans.

For example, a routine office visit might be reimbursed at $70 under Medicare but only $45 under a state Medicaid program.

Commercial Plans:

- In-network: Allowed amounts are based on the contracted rates you negotiate with the payer. For instance, a commercial PPO may allow $110 for the same office visit that Medicare pays $92 for.

- Out-of-network: Plans may calculate the allowed amount as a percentage of Medicare (e.g., 150% of Medicare’s rate), a UCR (Usual, Customary, and Reasonable) benchmark, or a proprietary formula.

- Under the No Surprises Act (NSA), patients generally cannot be balance billed for emergencies or certain services at in-network hospitals, even if the provider is out-of-network.

How To Calculate The Allowed Amount:

The allowed amount is the number that drives both insurance payments and patient responsibility. To avoid denials, short payments, and billing disputes, it’s essential to understand how this figure is applied in real-world claims.

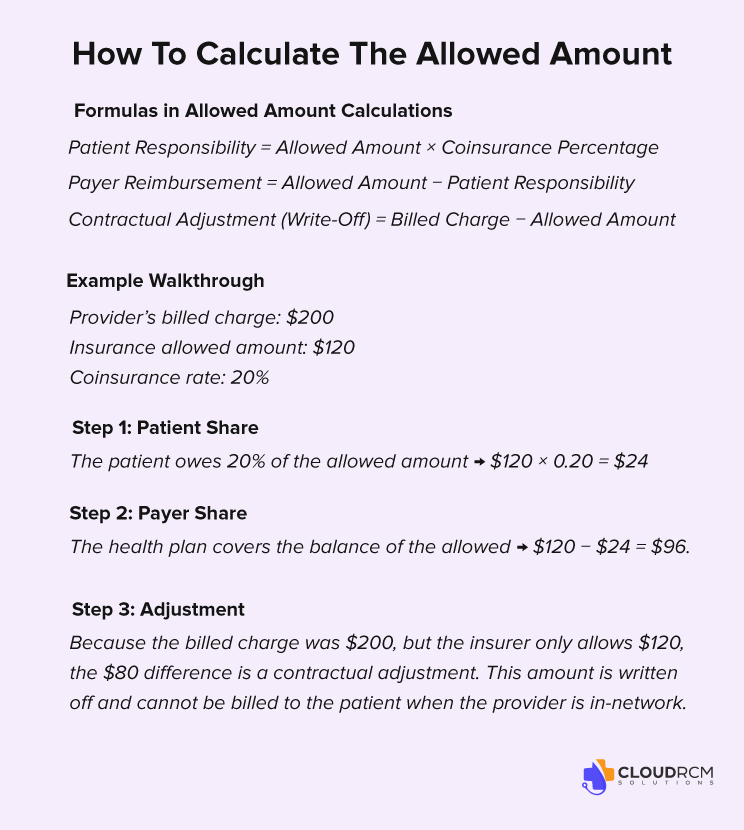

Key Formulas in Allowed Amount Calculations

When working with payer contracts, three simple formulas can help you verify payments:

- Patient Responsibility = Allowed Amount × Coinsurance Percentage

- Payer Reimbursement = Allowed Amount − Patient Responsibility

- Contractual Adjustment (Write-Off) = Billed Charge − Allowed Amount

Example Walkthrough

Let’s look at how this plays out for a common office visit:

- Provider’s billed charge: $200

- Insurance allowed amount: $120

- Coinsurance rate: 20%

Step 1: Patient Share

The patient owes 20% of the allowed amount → $120 × 0.20 = $24.

Step 2: Payer Share

The health plan covers the balance of the allowed → $120 − $24 = $96.

Step 3: Adjustment

Because the billed charge was $200, but the insurer only allows $120, the $80 difference is a contractual adjustment. This amount is written off and cannot be billed to the patient when the provider is in-network.

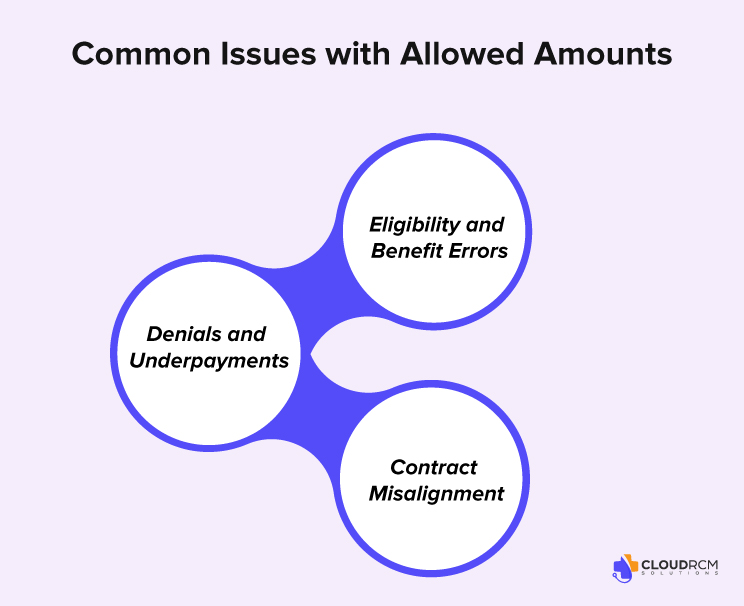

Common Issues with Allowed Amounts in Medical Billing

Even correctly coded claims can face payment delays or denials when allowed amounts are miscalculated or misapplied. These errors don’t just hurt reimbursements; they also damage patient trust and disrupt cash flow.

Denials and Underpayments

When payers apply the wrong allowed amount, providers often face underpayments or outright denials. According to a March 2024 MGMA Stat poll, 60% of medical group leaders reported an increase in claim denial rates compared to 2023.

Example: A payer may reimburse based on $90 instead of the contracted $120, leading to consistent revenue losses unless the discrepancy is caught and appealed.

Eligibility and Benefit Errors

Quoting deductibles or copays based on billed charges instead of allowed amounts creates patient confusion and unexpected balances. This is one of the leading causes of delayed or missed patient payments. Studies show that 49% of patients are more likely to switch providers after receiving a surprise medical bill.

Contract Misalignment

Using outdated fee schedules can leave providers writing off legitimate revenue. Industry reports estimate that providers lose between 1% and 11% of annual revenue due to underpayments.

How to Check an EOB for Accuracy

An Explanation of Benefits (EOB) shows how a claim was processed, but errors are common. To prevent revenue loss, providers should confirm these key points:

Codes vs. Contract: Make sure CPT/HCPCS codes match your payer contract. Downcoding (e.g., 99213 → 99212) should be appealed.

Network Status: Verify the claim was processed as in-network. Mislabeling in-network claims as out-of-network reduces payment.

Cost-Sharing: Check deductible, copay, and coinsurance. If the patient has already met their deductible, but it’s still applied, dispute it.

Recalculate: Use the formula:

Allowed – Copay – Coinsurance = Insurance Payment.

Insurance + Patient = Allowed. If not, it’s an error.

Escalate: If the math doesn’t add up, escalate with the payer using contract rates and eligibility proof.

Communicating with Patients About Allowed Amounts

Patients often struggle to understand why their bill looks different from the doctor’s charges. Keep it simple:

- Give Estimates Upfront: Base them on allowed amounts, not billed charges.

- Explain in Plain Language: “Your insurance sets the allowed amount. Your share comes from this number, not the full charge.”

- Break It Down Clearly: Show copay, deductible, and coinsurance separately to build trust and avoid disputes.

Transparent communication = fewer billing surprises + stronger patient relationships.

Allowed Amount vs. Adjusted Amount

Allowed Amount

- The maximum payment a payer allows for a covered service.

- Decides how much the insurance pays and what the patient owes (copay, deductible, coinsurance).

- Example: You bill $200 → Payer allows $120 → Insurance pays $90, patient pays $30.

Adjusted Amount

- The difference between your billed charge and the allowed amount.

- Also called a contractual write-off.

- It’s not billable to the patient if you’re in-network.

- Example: You bill $200 → Allowed amount is $120 → Adjusted amount is $80 (write-off).

Allowed Amount = What gets paid

Adjusted Amount = What gets written off

State Variations in Medicaid Allowed Amounts

Medicaid reimbursement rates vary widely from state to state, often significantly lower than Medicare. Understanding these differences can help providers better negotiate, estimate patient costs, and optimize billing strategies.

California vs. National Median (CPT 99213)

- In California, under Medi-Cal, the 2025 rate for CPT 99213 (established patient visit) is approximately $24.00.

- Nationally, Medicaid payments average around 67% of Medicare for primary care services.

Wider Disparities Across States

- A 2009 analysis showed that reimbursement f232or the same office visit ranged from $37 in Minnesota to $160 in Alaska, highlighting up to a 4x variance.

- Additionally, certain orthopedic procedures show state-to-state payment differences of more than $3,000.

Final Thoughts

The allowed amount is more than a number; it’s the foundation of reimbursements, patient costs, and your practice’s financial health. By understanding how it’s set, monitoring EOBs, and keeping contracts current, providers can reduce denials, improve collections, and deliver clearer communication to patients. In today’s complex billing environment, mastering allowed amounts isn’t optional; it’s a key step to protecting revenue and building patient trust.

Partner with CloudRCM to Maximize Your Reimbursements

Struggling with denied claims, underpayments, or confusing payer rules? CloudRCM helps healthcare providers stay ahead by auditing allowed amounts, reconciling contracts, and ensuring every claim is paid accurately. Our experts specialize in end-to-end revenue cycle management so you can focus on patient care while we protect your bottom line.

Reach out today to see how CloudRCM can boost your collection rates. Let’s schedule an appointment at your convenience.

FAQ’s

What does “Allowed Amount” mean in medical billing?

The allowed amount is the maximum fee a health plan will pay for a covered healthcare service. Also known as the “negotiated rate,” “eligible expense,” or “payment allowance,” it establishes both the insurer’s payment and the patient’s cost-sharing.

Why is the allowed amount different if I go out-of-network?

For in-network care, the allowed amount is a pre-negotiated rate. For out-of-network providers, insurers often use a Usual, Customary, and Reasonable (UCR) benchmark, which may be lower than the provider’s billed rate. Patients may be responsible for the difference unless protected under provisions like the No Surprises Act.

Can providers bill me for more than the allowed amount?

Yes, this is called balance billing. It occurs when an out-of-network provider charges above the allowed amount. In-network providers are generally prohibited from balance billing. The No Surprises Act offers further protection against surprise balance billing in many emergency and in-facility scenarios.

Medical Billing

Medical Billing Medical Coding

Medical Coding Medical Audit

Medical Audit Provider Credentialing

Provider Credentialing Denial Management

Denial Management A/R Follow-up

A/R Follow-up Private Practice

Private Practice Patient Help Desk

Patient Help Desk Customized Reporting

Customized Reporting Out-of-Network Billing

Out-of-Network Billing Internal Medicine

Internal Medicine Pediatrics

Pediatrics Radiology

Radiology Surgery

Surgery Emergency Medicine

Emergency Medicine Anesthesiology

Anesthesiology Cardiology

Cardiology Orthopedic

Orthopedic Psychiatry

Psychiatry Dentistry

Dentistry OB-GYN

OB-GYN Family Medicine

Family Medicine