Confused bills, denied claims, and frustrated patients all too often, these issues trace back to one root cause: poor insurance eligibility verification. Patients want clarity about what their insurance covers, yet many leave appointments unsure of their financial responsibility. According to Experian Health’s State of Patient Access 2024 survey, 56% of patients admit they struggle to understand their insurance coverage without provider guidance, and 61% believe clearer coverage explanations should be the top priority in healthcare access.

For providers, the stakes are even higher. Eligibility-related mistakes are a leading cause of denials, with 15% citing them among their top three revenue cycle challenges. The solution? Accurate, automated eligibility checks that not only protect revenue but also give patients financial confidence.

What Are Insurance Eligibility Checks?

Insurance eligibility checks happen before services are provided to confirm active coverage for planned treatment. This process ensures claims are sent properly and patients understand their financial responsibility upfront.

Without eligibility verification, providers may deliver care to uninsured patients or submit claims that get denied, resulting in billing inefficiencies and revenue loss.

Streamline Insurance Eligibility Before the Appointment

The pre-intake stage is your best chance to avoid claim denials and speed up reimbursements. By verifying insurance eligibility 1–3 days before the scheduled visit, you can catch coverage gaps early and set clear expectations with patients. Use appointment-setting calls or digital reminders to request essential details in advance.

1. Insurance Eligibility Verification Checklist

| Information Needed | Details to Collect |

|---|---|

| Patient Demographics | Full name, date of birth, address, phone number |

| Insurance Provider Info | Insurance name, phone number, and claims address |

| Policy Details | Policy number, group number |

| Secondary Insurance | Secondary policy information, if applicable |

| Subscriber/Insured Info | Name of insured, dependent details, relationship to patient |

| Coverage Dates | Effective date and end date of insurance policy |

| Active Coverage Check | Confirm whether coverage is currently active |

| Service Coverage | Verify if procedure/service is covered under the plan |

| Network Participation | Check if your practice participates in the patient’s plan |

| Policy Limitations | Exclusions, documentation requirements |

| Authorization Needs | Determine if prior authorization or referrals are required |

| Patient Responsibility | Confirm copay, deductible, and out-of-pocket amounts |

| Primary Subscriber (if different) | Primary subscriber’s name and date of birth |

2. Confirm Insurance Information Before Every Appointment

In 2025, insurance eligibility errors remain one of the top reasons for claim denials, with reports showing that nearly 20–25% of medical claim rejections are linked to inaccurate or outdated patient insurance data. Since 32% of Americans change jobs each year, many patients also switch health plans, making real-time verification critical.

That’s why the verification process must begin with collecting, checking, and verifying patient information at every visit whether they are new or established patients.

- Ask for the insurance card: For new patients, confirm the card against the details gathered during pre-intake. If issues appear in the eligibility check, clarify directly with the patient. For returning patients, confirm any changes in demographics or policies since their last visit.

- Keep a fresh copy: Maintaining an updated copy in your system ensures your records match what’s on file with the payer and reduces errors during claim submission.

It may feel repetitive to verify eligibility multiple times, but the cost of a denied claim far outweighs the effort. Practices that implement 100% pre-visit eligibility verification see up to a 30% drop in claim rejections and significant improvements in collections.

3. Revisit Your Insurance Verification Checklist

Once you have the insurance card, every piece of information must be captured with precision. Even small errors like a misspelled name or missing policy number can lead to denials.

- Use a standardized checklist from pre-intake to confirm all required data.

- Go digital where possible. Modern practice management systems integrate billing, offer real-time eligibility checks, and automate data transfers, cutting down manual errors and saving your team hours each week.

4. Contact the Insurance Provider

After entering the patient’s details, confirm directly with their insurance provider. The best time to do this is before the appointment, not after a claim denial.

- Manual phone verification can take 20–30 minutes per patient, creating staff bottlenecks.

- Automated eligibility verification tools now allow you to check coverage with hundreds of payers in seconds, reducing administrative burden and accelerating reimbursements.

5. Record Complete and Accurate Information in the Patient File

Once verified, transfer all data to the patient’s file or EHR. Accuracy at this stage is critical—errors here ripple downstream into denied claims and delayed payments.

If possible, leverage automation technologies like Robotic Process Automation (RPA) to handle repetitive, error-prone steps. Practices using automation report up to 40% fewer billing errors and faster turnaround on claims.

Smarter Insurance Eligibility Checks: The Key to Reducing Claim Denials

One of the biggest challenges in medical billing is catching eligibility issues before they turn into costly denials. By adopting smarter, automated verification practices, providers can minimize financial risk, improve patient trust, and keep their revenue cycle running smoothly.

Best Practices for Reliable Insurance Eligibility Checks

- Automate real-time eligibility checks for accuracy and speed

Instead of relying on manual lookups, automation verifies insurance coverage and plan-specific benefits both before and at the time of service. This ensures registration is faster and helps catch coverage gaps early—before they lead to denied claims. Automation also reduces staff workload and human error. - Track payer policy changes automatically

With payer rules constantly shifting, automation is essential. Eligibility verification systems connect with hundreds of payers, updating policy requirements in real time. Combined with automated pre-authorization tools, providers can stay ahead of payer updates and flag missing requirements before claims are submitted. - Provide patients with upfront, automated cost estimates

Nearly 80% of patients report that price estimates improve their care experience. Automated eligibility checks paired with real-time cost estimates help patients understand co-pays, deductibles, and out-of-pocket costs before their visit. This improves financial transparency, boosts satisfaction, and accelerates collections.

Why It Matters

Implementing these practices not only ensures smoother claim submissions but also significantly reduces denials tied to eligibility issues ultimately strengthening your revenue cycle and freeing staff to focus on patient care.

Real-World Impact: Providence Health’s Success

Providence Health leveraged automated eligibility verification to uncover $30M in previously missed coverage and cut denial rates dramatically. Within just five months, the organization had already saved $18M in potential losses, while improving staff productivity and patient satisfaction.

Conclusion

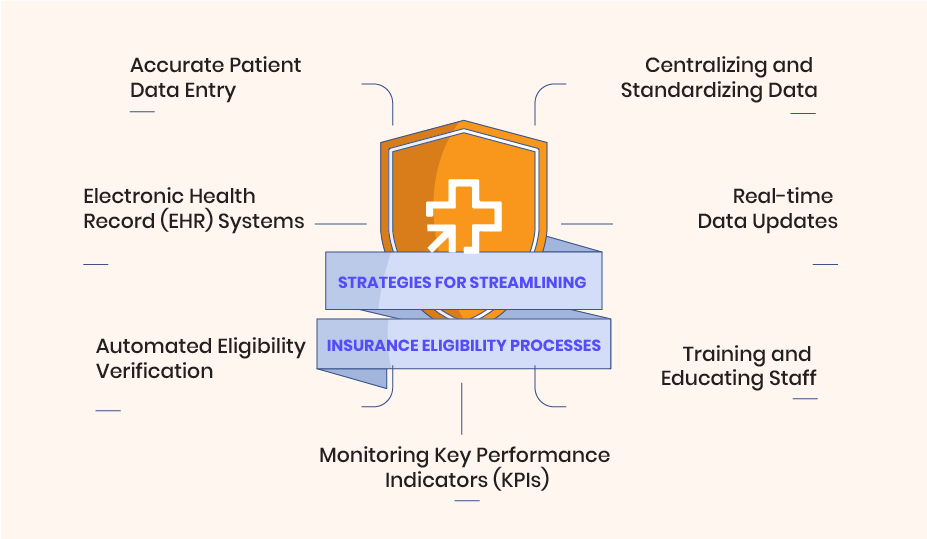

The successful implementation of best practices for insurance eligibility helped TeamUp Healthcare Center improve efficiency, reduce errors, and deliver better patient care.

By adopting EHR systems, automated verification tools, and centralized data management, providers streamlined operations and minimized claim denials.

CloudRCM delivers advanced solutions to simplify insurance verification and enhance patient experiences. Schedule an appointment today and see how we can transform your practice for long-term success.

FAQ’s

How can you improve insurance eligibility verification efficiency?

By adopting electronic health record (EHR) systems, you can access patient data more conveniently. Implement automated eligibility verification tools to reduce manual tasks and errors. Centralize data for easier management and faster verifications.

Why is accurate patient data entry essential for eligibility processes?

Ensuring precise data entry minimizes delays and claim denials. Accurate information improves the overall verification and billing process. Valid insurance details lead to smoother patient experiences and better outcomes.

What are the benefits of integrating EHR systems in your practice?

EHR systems provide quick access to patient records and insurance data. Seamless integration streamlines eligibility processes and reduces administrative burden. Real-time updates keep information current and readily available.

How do real-time data updates contribute to efficiency in eligibility processes?

Real-time updates provide instant access to patients’ insurance information. This streamlines the eligibility verification process and reduces delays. Up-to-date data improves overall efficiency in insurance-related tasks.

What are the challenges healthcare providers face in eligibility processes?

Providers deal with the complexities of multiple insurance plans and varying requirements. Manual eligibility checks can lead to errors and delays in verification. Keeping up with policy changes poses challenges without automation.

Medical Billing

Medical Billing Medical Coding

Medical Coding Medical Audit

Medical Audit Provider Credentialing

Provider Credentialing Denial Management

Denial Management A/R Follow-up

A/R Follow-up Private Practice

Private Practice Patient Help Desk

Patient Help Desk Customized Reporting

Customized Reporting Out-of-Network Billing

Out-of-Network Billing Internal Medicine

Internal Medicine Pediatrics

Pediatrics Radiology

Radiology Surgery

Surgery Emergency Medicine

Emergency Medicine Anesthesiology

Anesthesiology Cardiology

Cardiology Orthopedic

Orthopedic Psychiatry

Psychiatry Dentistry

Dentistry OB-GYN

OB-GYN Family Medicine

Family Medicine