As the healthcare industry is growing, Nurse Practitioners and physician assistance are becoming an essential part of the healthcare workforce. According to recent research, almost 37% from 2021 to 2031, these providers play a vital role in addressing physician shortages and expanding care options. By 2025, over 60% of primary care practices will likely employ NPs or PAs.

With this rise, Medical Billing and Coding for these providers becomes even more important. Understanding how to bill for NPs and PAs properly ensures your practice stays compliant, optimizes reimbursement, and avoids costly mistakes. Let’s explore the essential billing practices for smooth financial operations.

Importance Of Nurse Practitioners And Physician Assistants In Healthcare

Healthcare practices increasingly rely on Nurse Practitioners (NPs) and Physician Assistants (PAs) to meet growing patient needs. Nearly 40% of primary care practices now employ at least one NP or PA, and this number is set to rise. These skilled providers offer a cost-effective solution to handle routine care, diagnosis, treatment, and follow-ups.

Given their expanding scope of care, it’s essential that medical billing is handled precisely to secure correct reimbursements and maintain regulatory compliance.

What Is The Difference Between Nurse Practitioners And Physician Assistants

Nurse Practitioners (NPs) and Physician Assistants (PAs) are both advanced healthcare providers but with different backgrounds. NPs, with a nursing background, focus on holistic, patient-centered care and work mainly in primary care, diagnosing, prescribing, and managing treatments. PAs, from a medical background, work alongside physicians, diagnosing, treating, and performing procedures. Both can work independently, but their training and scope of practice vary.

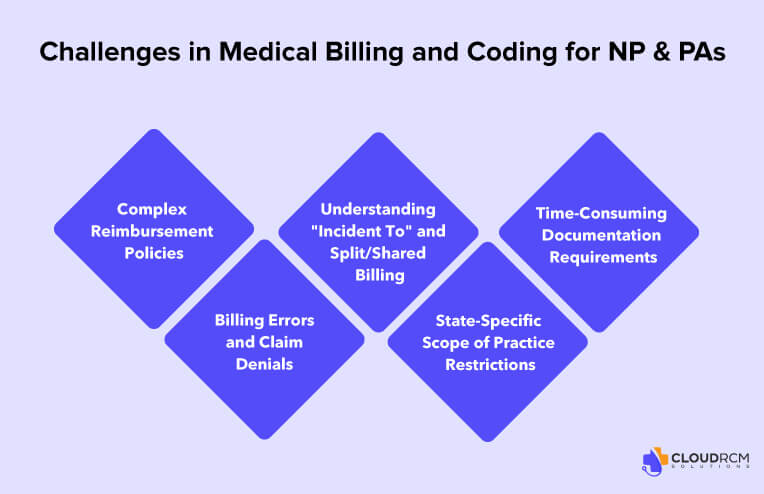

Common Billing and Coding Challenges for NP & PAs

As the role of Nurse Practitioners (NPs) and Physician Assistants (PAs) continues to expand, medical billing and coding for these providers comes with unique challenges. Errors in billing can lead to claim denials, compliance issues, and financial losses for medical practices. Here are the key challenges and solutions to improve efficiency and maximize reimbursements.

Complex Reimbursement Policies

Reimbursement rates for NPs and PAs vary across Medicare, Medicaid, and private insurers. Medicare, for example, reimburses NPs and PAs at only 85% of the physician rate, creating financial challenges for practices. Additionally, not all insurance providers credential NPs and PAs, making direct billing difficult.

Solution:

- Ensure proper credentialing for NPs and PAs with each insurance provider.

- Utilize “Incident To” billing when applicable to receive 100% of the Medicare Physician Fee Schedule (MPFS).

- Stay updated on payer-specific rules to avoid claim denials and underpayments.

Billing Errors and Claim Denials

Incorrect coding, missing documentation, and failure to meet payer guidelines often result in claim denials and revenue loss. Many billing teams are unfamiliar with NP- and PA-specific coding rules, leading to frequent errors.

Solution:

- Outsource medical billing to reduce manual errors.

- Provide ongoing billing and coding training for staff handling NP and PA claims.

- Conduct regular audits to ensure coding accuracy and compliance with payer requirements.

How Billing Errors Affect Patient Satisfaction

Incorrect medical billing not only impacts a practice’s revenue but also affects patient trust and experience.

- Surprise Out-of-Pocket Costs: If claims are denied due to coding errors, patients may be responsible for unexpected medical expenses.

- Delayed Care Access: Billing issues can prevent timely access to necessary treatments if claims are rejected and require reprocessing.

- Reduced Patient Trust: Frequent billing errors can damage a practice’s reputation and patient retention.

Understanding “Incident To” and Split/Shared Billing

Many practices struggle with the proper use of “Incident To” and split/shared billing, leading to compliance risks. “Incident To” requires a physician to be present in the office during the NP or PA’s service, and split/shared billing demands clear documentation of both providers’ contributions.

Solution:

- Train staff on when and how to apply “Incident To” billing correctly.

- Ensure thorough documentation when using split/shared billing to justify full reimbursement.

- Verify that state and payer policies align before submitting claims under these billing models.

State-Specific Scope of Practice Restrictions

Billing rules for NPs and PAs vary widely across states. Some states require physician supervision, while others allow NPs full practice authority. These variations impact how services can be billed and reimbursed.

Solution:

- Stay informed about state-specific regulations on NP and PA billing.

- Advocate for legislative changes to expand billing opportunities where restrictions exist.

- Work with medical billing specialists to ensure compliance with local laws.

Time-Consuming Documentation Requirements

Proper documentation is critical for accurate coding and reimbursement, but it can be time-consuming. Inadequate documentation often leads to downcoding or claim denials.

Solution:

- Use Electronic Health Records (EHR) systems to improve the documentation.

- Implement voice-to-text dictation tools to speed up charting.

- Train NPs and PAs on efficient charting practices to meet payer requirements.

Recent and Upcoming Policy Changes Impacting NP & PA Billing

The regulatory landscape for NPs and PAs continues to evolve, affecting reimbursement rates, credentialing requirements, and supervision rules. Here are some key updates:

- Medicare’s 2024 Fee Schedule Updates: The Centers for Medicare & Medicaid Services (CMS) recently updated reimbursement rates for NPs and PAs, affecting direct billing and “Incident To” services.

- Expanded Scope of Practice in Certain States: Some states, like California and Massachusetts, have granted full practice authority to NPs, allowing them to bill independently at higher reimbursement rates.

- Telehealth Reimbursement Extensions: Temporary waivers during the COVID-19 pandemic led to increased telehealth billing opportunities, many of which have now been extended permanently for NPs and PAs.

Billing Guide for Nurse Practitioners and Physician Assistants

Proper billing for Nurse Practitioners (NPs) and Physician Assistants (PAs) ensures accurate reimbursements and compliance. Here’s a better approach to key billing methods:

Direct Billing (85% Medicare Rate)

NPs and PAs can bill independently using their National Provider Identifier (NPI) but receive 85% of the physician’s reimbursement rate. Ensure credentialing with Medicare, Medicaid, and private insurers to avoid claim denials.

“Incident To” Billing (100% Medicare Rate)

Allows NPs/PAs to bill under a supervising physician’s NPI at full reimbursement if:

- The physician established the treatment plan.

- The NP/PA provides follow-up care under direct supervision.

- The physician is available in the office during services.

Split/Shared Billing

When both an NP/PA and a physician contribute to a visit (e.g., history, exam, or decision-making), the service can be billed under the physician’s NPI for full reimbursement. Documentation of both providers’ contributions is required.

Rural and Underserved Areas

Certain Medicare programs offer higher reimbursement for NP/PA services in rural or underserved areas. Check state-specific regulations to determine billing eligibility.

Essential Billing Modifiers

- -25: Separate E/M service on the same day as a procedure.

- -AS: Assistant at surgery (for PAs).

- -PA: Service provided by a physician assistant.

Compliance with State Regulations

Billing rules vary by state. Some states allow independent NP billing, while others require physician oversight. Regularly update credentialing and billing systems to stay compliant.

How to Bill for Specialized NP & PA Services

Beyond general medical care, NPs and PAs work in specialty areas such as:

- Mental Health: Use CPT codes 90791 (Psychiatric diagnostic evaluation) and 90837 (60-minute psychotherapy session). Medicare reimburses NPs for mental health services at 85% of the physician rate.

- Surgical Assistance: PAs assisting in surgery must use the -AS modifier for appropriate reimbursement under Medicare.

- Chronic Disease Management: Medicare’s Chronic Care Management (CCM) program allows NPs to bill CPT 99490 for at least 20 minutes of care coordination per month

Improving Financial Health Through Efficient NP & PA Billing

Managing the financial health of a practice requires strategic billing approaches:

- Credentialing & Payer Contracts: Ensure all NPs and PAs are properly credentialed with insurers to avoid reimbursement delays.

- Revenue Cycle Management (RCM) Integration: Using RCM software can streamline claims submissions and improve cash flow.

- Preemptive Auditing: Conduct routine internal audits to identify billing errors before claims are submitted, reducing revenue loss.

Final Thoughts

Efficient medical billing is the backbone of a financially successful practice. With the growing demand for NP and PA services, staying ahead of evolving billing regulations is crucial. CloudRCM is committed to providing seamless revenue cycle management solutions that enhance cash flow, reduce administrative burdens, and keep your practice compliant. Partner with us to ensure optimized reimbursements, fewer billing errors, and a stress-free billing experience.

Why Choose CloudRCM for NP & PA Medical Billing?

Maximizing revenue while ensuring compliance can be challenging for healthcare providers. CloudRCM specializes in medical billing for Nurse Practitioners (NPs) and Physician Assistants (PAs), helping practices in claims processing, reducing denials, and increasing reimbursements. Our expert team stays updated on the latest Medicare, Medicaid, and private-payer policies to ensure accurate coding and full reimbursement for every service provided. CloudRCM simplifies the billing process so that NPs and PAs can focus on patient care while we handle the complexities of medical billing.

Feel free to reach us at (224) 231-6880. We can help you with the complexities.

FAQs

What codes are used for NP visits in a physician’s office?

Nurse Practitioners (NPs) and Physician Assistants (PAs) typically use the same office visit codes as physicians—CPT codes 99201–99215—when evaluating and managing patients in a physician’s office.

What are the billing requirements for NP or PA services billed under their name?

When billing under an NP or PA’s own National Provider Identifier (NPI), specific requirements must be met, including credentialing with payers and following reimbursement guidelines.

How does Medicare reimburse Physician Assistants (PAs)?

Medicare reimburses PAs at 85% of the Physician Fee Schedule (PFS) for services provided outside hospital or skilled nursing facility (SNF) settings.

Where can I find more information on NP & PA billing and coding?

For up-to-date guidelines, consult the American Academy of Family Physicians (AAFP) and the Centers for Medicare & Medicaid Services (CMS). These resources provide detailed policies, reimbursement rates, and coding best practices.

Medical Billing

Medical Billing Medical Coding

Medical Coding Medical Audit

Medical Audit Provider Credentialing

Provider Credentialing Denial Management

Denial Management A/R Follow-up

A/R Follow-up Private Practice

Private Practice Patient Help Desk

Patient Help Desk Customized Reporting

Customized Reporting Out-of-Network Billing

Out-of-Network Billing Internal Medicine

Internal Medicine Pediatrics

Pediatrics Radiology

Radiology Surgery

Surgery Emergency Medicine

Emergency Medicine Anesthesiology

Anesthesiology Cardiology

Cardiology Orthopedic

Orthopedic Psychiatry

Psychiatry Dentistry

Dentistry OB-GYN

OB-GYN Family Medicine

Family Medicine