You stabilize emergencies. You perform surgeries. You diagnose and treat complex cases often without knowing a patient’s insurance network status.

Still, despite delivering medically necessary care, the moment the patient leaves your facility, the reimbursement fight begins. Out-of-network (OON) claims erode revenue, lengthen payment cycles, and overwhelm billing teams. Denials, low reimbursement offers, and endless appeals have become the norm, even for clean claims.

Recent data shows 31% of emergency and hospital-based claims are process out-of-network, and nearly 50% get paid below fair-market value. Compounded by No Surprises Act (NSA) compliance pressures and payer-driven negotiation models, practices experience:

- Unavoidable revenue leakage

- Prolonged days-in-A/R

- High administrative throughput and appeals burden

- Volatile cash flow and reimbursement variability

This article explains OON reimbursement strategy and how CloudRCM Solutions uses data-driven, NSA-compliant negotiation to secure fair payment for non-contracted services.

The Growing Importance of Out-of-Network Negotiation

The No Surprises Act (NSA) protects patients from unexpected out-of-network bills but has shifted the financial burden onto providers. With balance billing restricted, payers control most reimbursement negotiations. Without a solid strategy, providers face underpayments, delays, and compliance risks. The MGMA 2025 report shows practices using professional negotiators recover 35% more revenue than those handling disputes internally, highlighting the growing need for structured out-of-network claim negotiation.

Why Emergency Room and Hospital-Based Providers Are Most Affected

Emergency departments are among the hardest hit by out-of-network ER Billing and reimbursement issues. Because emergency care is provided without regard to a patient’s insurance network, many claims fall outside of payer contracts.

Data shows that approximately 65% of emergency room visits include at least one out-of-network service component. Similarly, anesthesiologists, radiologists, and surgeons frequently treat patients in facilities with payer contracts they themselves may not hold.

- Anesthesiology: Around 42% of anesthesia claims are billed out-of-network due to limited payer relationships or facility-specific contracts.

- Radiology: Imaging and diagnostic centers often experience underpayments when they operate as non-contracted entities.

- Surgery and Orthopedics: Complex surgical cases frequently involve disputes over medical necessity and coding.

- Behavioral Health: Private mental health practices struggle with inconsistent payer reimbursements and long adjudication times.

For these specialties, Out-of-Network ER Billing negotiation is not just a revenue recovery tactic it’s a financial necessity. With proactive negotiation strategies and expert support, providers can secure fair compensation while maintaining compliance and operational stability.

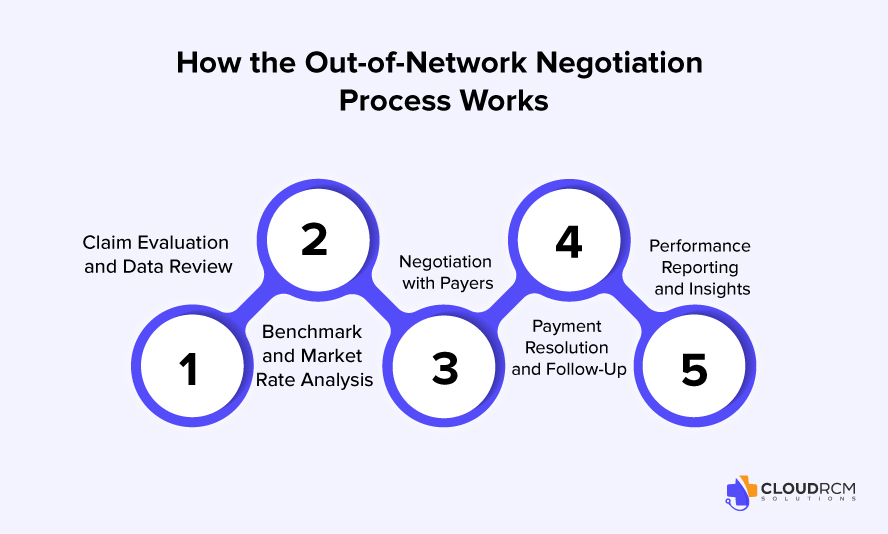

How the Out-of-Network Negotiation Process Works

Effective Out-of-Network Negotiation Services follow a structured, compliance-driven process to ensure providers receive fair and timely reimbursements. Here’s how Cloud RCM Solutions manages each step from claim review to payment resolution:

1. Eligibility & Case Review

Our negotiation specialists begin by reviewing all essential details of your claim, including:

- Payer’s plan language and OON benefits

- Usual, Customary, and Reasonable (UCR) rates

- Service documentation, CPT codes, and clinical justification

- Applicable federal and state regulations (No Surprises Act, ERISA, etc.)

This comprehensive review helps identify potential payment gaps and strengthens your negotiation position from the start.

2. Claim Submission or Reprocessing

If your out-of-network claim has not yet been submitted, we ensure it’s clean, compliant, and supported by strong documentation for optimal first-pass success.

If the claim was previously denied or underpaid, we reprocess it with updated clinical notes, corrected codes, and enhanced payer documentation — minimizing the chance of further disputes.

3. Payer Outreach and Negotiation

Once the claim is ready, our negotiation experts directly engage with payer representatives using:

- Market-rate benchmarks and historical payment data

- UCR and Medicare comparisons

- Medical necessity documentation

- Federal and state billing compliance references

Negotiations occur via phone, secure electronic communication, or payer negotiation portals, ensuring consistent follow-through and transparency at every stage.

4. Offer Evaluation and Settlement

After negotiation, payers provide a settlement or counteroffer. We guide providers through evaluating these offers based on:

- Market data and fair-value benchmarks

- Prior claim history and precedent

- Legal and financial feasibility

Depending on the case, providers can accept the negotiated rate, submit for arbitration, or pursue other legal reimbursement options when permitted.

5. Resolution and Payment Posting

Once an agreement is finalized, Cloud RCM Solutions oversees the entire resolution process — ensuring payment posting, follow-up on any discrepancies, and detailed reporting for full transparency.

Our clients receive structured documentation of every negotiation, making future claims easier to manage and benchmark.

6. Reporting and Financial Insights

We close each negotiation with comprehensive analytics reports detailing:

- Recovery rates

- Turnaround times

- Payer-specific trends

- Denial reasons and future prevention strategies

This data helps your practice make smarter financial decisions and forecast revenue with confidence.

Why This Process Matters

By following this evidence-based negotiation process, Cloud RCM Solutions helps healthcare providers:

- Recover fair market value for out-of-network claims

- Reduce administrative burden and A/R days

- Maintain compliance with NSA and ERISA laws

- Strengthen financial stability and predictability

This process not only helps maximize reimbursements but also improves financial predictability for healthcare organizations.

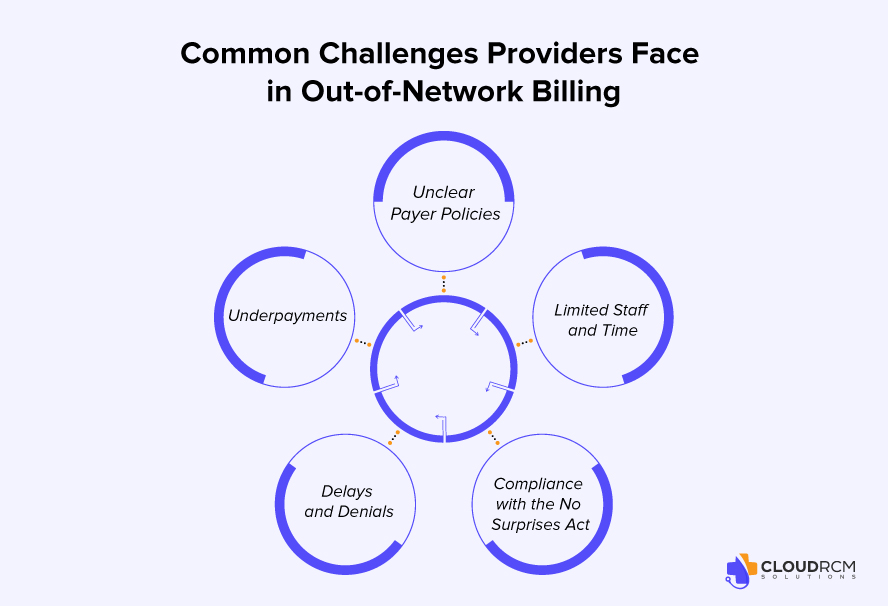

Common Challenges Providers Face in Out-of-Network Billing

Even when a claim is properly coded and documented, several factors can lead to payment delays or underpayments:

- Opaque Payer Formulas: Many insurers use proprietary calculations to determine OON payments, making it difficult to anticipate reimbursement amounts.

- Low Settlement Offers: Initial payer offers may represent only 20 – 40% of billed charges.

- Administrative Delays: Prolonged documentation reviews can significantly increase accounts receivable (A/R) cycles.

- Regulatory Complexity: Compliance with the NSA and state-specific laws requires constant monitoring.

- Limited Staff Capacity: Handling appeals and negotiations internally strains billing departments already managing high claim volumes.

For many practices, outsourcing negotiation to specialized RCM partners offers both efficiency and stronger financial outcomes.

Data-Driven Strategies to Improve OON Reimbursement

Before engaging external support, practices can take several steps to strengthen their negotiation position:

- Ensure Accurate Documentation: Every CPT code and diagnosis should have a clear clinical justification.

- Use Benchmarking Data: Compare charges to local and national benchmarks to establish defensible rates.

- Monitor Payer Behavior: Track patterns in denials or low offers to develop data-backed responses.

- Leverage Analytics: Use RCM dashboards to analyze turnaround times, appeal outcomes, and payer trends.

- Standardize Appeals: Establish templates for appeals supported by strong medical documentation and compliance references.

Practices that routinely track payer performance metrics have been shown to reach settlements up to 20% faster than those that do not.

The Measurable Impact of Professional OON Negotiation

Partnering with an experienced out-of-network negotiation service can significantly improve financial outcomes. In 2025, practices working with professional negotiators achieved:

- 28–35% higher average reimbursements on OON claims

- 22% reduction in days in A/R

- Greater transparency through performance reporting and claim tracking tools

These results demonstrate that negotiation services not only recover lost revenue but also enhance operational efficiency.

Compliance, Transparency, and Long-Term Stability

A reliable negotiation partner should operate with complete transparency and full compliance with the No Surprises Act, ERISA, and relevant state laws. Providers should have access to progress reports, data analytics, and finalized documentation for every negotiated claim. Organizations such as Cloud RCM Solutions have built specialized OON departments that manage the entire negotiation lifecycle from claim audit to settlement, allowing providers to focus on clinical operations while maintaining steady cash flow.

Conclusion

Out-of-network billing will continue to be a complex area of healthcare revenue cycle management. However, with structured negotiation strategies, accurate data, and compliance-focused processes, providers can convert unpredictable claims into consistent, fair reimbursements.

In an era of evolving payer rules and increased regulatory oversight, proactive OON negotiation represents not just a recovery tool but a pathway to long-term financial stability for healthcare providers across the U.S.

Schedule an appointment today and let CloudRCM Solutions turn your complex claims into consistent, predictable revenue.

FAQ’s

What are out-of-network negotiation services, and how do they benefit healthcare providers?

Out-of-network negotiation services help providers recover fair payments from insurance companies for non-contracted claims. By leveraging payer data and benchmark rates, experts negotiate higher reimbursements, reducing losses and improving cash flow.

How does the No Surprises Act affect out-of-network billing and provider reimbursement?

The No Surprises Act limits balance billing, shifting the negotiation responsibility to providers. This makes structured, compliant out-of-network negotiations essential to secure fair payment from payers without violating patient protection laws.

Which specialties benefit most from out-of-network claim negotiation?

Emergency medicine, anesthesiology, radiology, surgery, and behavioral health providers often rely on out-of-network negotiations due to frequent non-contracted cases and payer underpayments.

How long does it take to resolve an out-of-network claim negotiation?

Timelines vary based on payer responsiveness and documentation quality, but professional negotiators like Cloud RCM Solutions typically achieve settlements within 30–60 days, significantly faster than in-house teams.

Why should providers outsource out-of-network negotiations to Cloud RCM Solutions?

Cloud RCM Solutions offers data-backed negotiation, regulatory compliance, and transparent reporting — helping providers secure 28–35% higher reimbursements and reduce A/R days through expert payer engagement.

Medical Billing

Medical Billing Medical Coding

Medical Coding Medical Audit

Medical Audit Provider Credentialing

Provider Credentialing Denial Management

Denial Management A/R Follow-up

A/R Follow-up Private Practice

Private Practice Patient Help Desk

Patient Help Desk Customized Reporting

Customized Reporting Out-of-Network Billing

Out-of-Network Billing Internal Medicine

Internal Medicine Pediatrics

Pediatrics Radiology

Radiology Surgery

Surgery Emergency Medicine

Emergency Medicine Anesthesiology

Anesthesiology Cardiology

Cardiology Orthopedic

Orthopedic Psychiatry

Psychiatry Dentistry

Dentistry OB-GYN

OB-GYN Family Medicine

Family Medicine