As telehealth continues to transform healthcare delivery, accurate billing and coding for Medicare Fee-for-Service (FFS) claims have never been more important. Providers who offer virtual care and billing companies that support them must stay up to date with the latest policies, codes, and modifiers to ensure clean claims and prompt reimbursement.

In this guide, we break down how to correctly bill Medicare telehealth services in 2025, avoid common mistakes, and use up-to-date guidance from telehealth.hhs.gov.

What Does Fee-for-Service Mean in Medicare Telehealth Billing?

Medicare Fee-for-Service (FFS) is a traditional payment model where providers are reimbursed separately for each service delivered, whether it’s an evaluation, therapy session, or remote patient monitoring.

Unlike value-based care, which ties payment to patient outcomes, FFS strictly relies on accurate coding, POS entries, and modifier use. This makes precise billing essential when submitting telehealth claims. A single error can mean lost revenue or audit risk.

Why Medicare Telehealth Billing Matters More Than Ever

Telehealth isn’t just a pandemic-era convenience; it’s now a permanent part of how many providers deliver care. In fact, over 250 Medicare-covered telehealth services are reimbursable as of 2025, making it a vital revenue stream.

But with opportunity comes complexity. Medicare telehealth billing is riddled with technical requirements, from POS codes and modifiers to service location rules. Getting even one field wrong can lead to denials or audits.

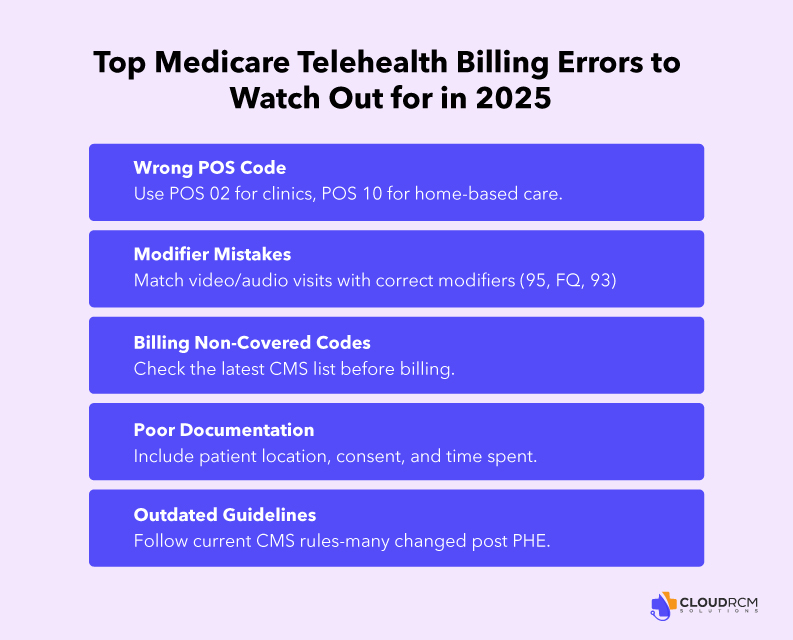

Top Medicare Telehealth Billing Errors to Watch Out for in 2025

Medicare telehealth billing in 2025 isn’t as simple as just entering a CPT code and hitting submit. While the expansion of covered services is a huge win for providers, it also opens the door to costly mistakes, especially if you’re still relying on outdated processes or haven’t fully adapted to the latest billing rules.

If your team is billing Medicare Fee-for-Service (FFS) claims for virtual care, here are some of the most common telehealth billing mistakes that could lead to denials, delays, or even audits.

Using The Wrong Place Of Service Code:

One of the most overlooked errors is missing the POS codes in medical billing claims, which can lead to denials or delays. Medicare strictly distinguishes between whether the patient is at home or hospital.

| POS Code | Description | Use Case |

|---|---|---|

| POS 02 | Telehealth services provided when the patient is not at home | Telehealth services are provided while the patient is at home |

| POS 10 | Telehealth services are provided while the patient is at home. | Patient receives telehealth care from their residence |

When to Use POS 10 vs POS 02 in Medicare Telehealth Billing

Correctly choosing between POS 10 and POS 02 is essential for Medicare telehealth billing accuracy in 2025. These codes reflect the patient’s location at the time of the telehealth encounter, and using the wrong one can lead to denials or audits.

| POS Code | When to Use | Location | Example |

|---|---|---|---|

| POS 10 | Telehealth provided in the patient’s home | Patient is in their private residence | A Medicare patient joins a video telehealth follow-up from their home via smartphone to speak with their cardiologist. |

| POS 02 | Telehealth provided outside the patient’s home | Patient is in a facility such as a SNF, clinic, RHC, dialysis center, etc. | A patient connects with a specialist from a rural health clinic offering telehealth services. Since the patient is not at home, POS 02 applies. |

Applying incorrect or missing modifiers:

Modifier indicates to Medicare how the service was performed, whether it was through a video call or an audio call. These are the fundamental yet important things you should always consider while submitting claims.

Using the wrong one or skipping it altogether can result in claims being flagged or rejected.

- Modifier 95 – Indicates a real-time, synchronous telehealth service with both audio and video.

- Modifier FQ – Designates an audio-only telehealth visit using specific CPT codes.

- Modifier 93 – Applies to audio-only E/M or therapy services, depending on the CPT instructions.

Billing for Non-Covered Telehealth Services

Not every telehealth service is covered under Medicare, even if it was during the COVID-19 public health emergency. If you’re billing a code that’s no longer listed on CMS’s covered telehealth services list, you’re likely to receive a denial.

Providers should reference the CMS Medicare Telehealth Services List, which is updated regularly and includes over 250 codes approved through 2025.

Incomplete or Insufficient Documentation

Telehealth visits must be documented just as thoroughly as in-person encounters. Missing elements like consent, the communication method used (audio/video), patient location, or session duration can leave your claim vulnerable in an audit.

Following Outdated Medicare Billing Guidelines

Medicare’s telehealth rules have evolved significantly over the past few years, and they continue to shift. Relying on old billing habits or pre-2023 guidance is a recipe for denied claims.

Key changes for 2025 include:

- Continued use of audio-only codes through September 30, 2025

- The need for modifiers and accurate POS coding

- Expiring flexibilities tied to the COVID-19 PHE

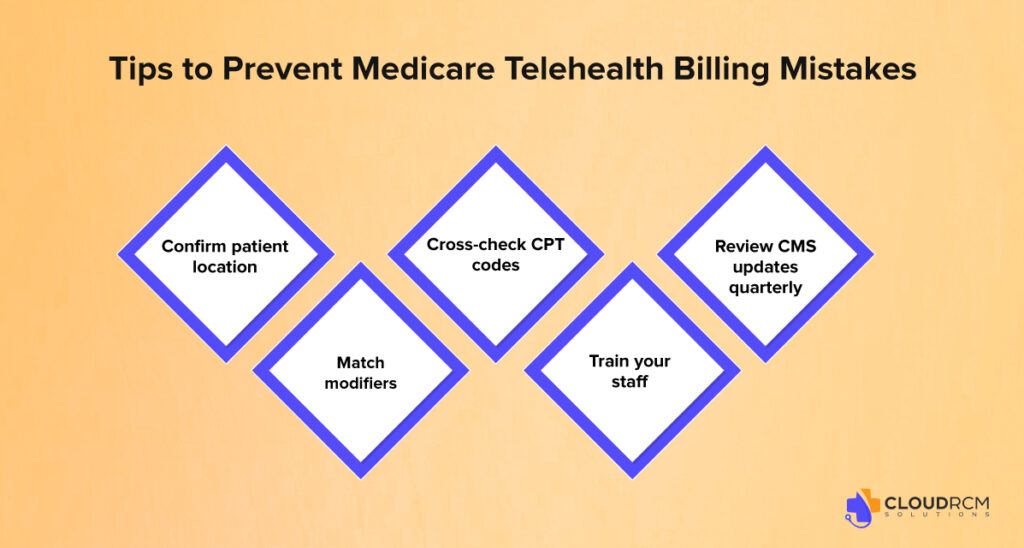

Tips to Prevent Medicare Telehealth Billing Mistakes

Now that you know the most common errors, here are practical ways to keep your billing process compliant and clean:

- Confirm patient location at the time of service to apply the right POS code (02 or 10).

- Match modifiers (95, FQ, 93) to the delivery method used; don’t assume audio-only services are automatically covered.

- Cross-check CPT codes against the latest CMS telehealth services list before submission.

- Train your staff on new documentation requirements for virtual care.

- Review CMS updates quarterly, especially as policies shift around the public health emergency.

Where to Enter POS and Modifiers on the CMS-1500 Claim Form

For accurate Medicare telehealth billing, knowing where to place POS codes and modifiers on the claim form is essential.

CMS-1500 Paper Claims:

- Box 24B (Place of Service):

Enter the correct POS code: use POS 10 if the patient is at home or POS 02 if outside the home (e.g., clinic or SNF).

- Box 24D (CPT/HCPCS + Modifiers):

Add the CPT or HCPCS code followed by applicable modifiers (e.g., 95, 93, or FQ).

Example: 99213 95

837P Electronic Claims:

- Loop 2300, CLM05-1: POS code

- Loop 2400, SV1-2: CPT/HCPCS code and modifiers

EHR and Clearinghouse Tip:

Ensure your billing system supports multiple modifiers and correctly transmits POS codes to the clearinghouse. Always run a pre-submission check to catch format issues early.

2025 Medicare Telehealth Billing Codes

Telehealth has become a permanent fixture in the U.S healthcare system, and staying updated with the Medicare telehealth billing codes is essential to avoid denials and optimize reimbursements. Whether you’re billing for E/M visits, behavioral health, or remote patient monitoring, using the right codes and the correct place of service and modifiers is the key.

Below is a categorized list of approved CPT and HCPCS codes for Medicare telehealth billing in 2025, along with notes on common use cases and billing requirements.

Medicare Telehealth CPT & HCPCS Code Reference (2025)

| Category | Codes | Use Cases | Common Modifiers | POS |

| Evaluation & Management (E/M) | 99202–99215 | Office visits for new and established patients | 95 | POS 10 |

| Behavioral Health | 90832–90837, G0320–G0324 | Therapy, mental health, crisis care | 95 / FQ / 93 | POS 10 |

| Remote Patient Monitoring (RPM) | 99453, 99454, 99457, 99458 | Monitoring vitals/devices at home | None required | POS 10 |

| Virtual Check-Ins | G2010, G2012 | Brief patient-initiated consults via audio/video | 95 / 93 | POS 10 |

| Chronic Care Management (CCM) | 99490, 99491, 99487 | Ongoing care coordination for chronic conditions | None required | POS 10 |

Medicare Telehealth Billing in 2025: What’s Changing?

The landscape of Medicare telehealth billing in 2025 continues to evolve, and staying compliant means keeping up with the latest federal rules. Thanks to the Consolidated Appropriations Act of 2023, many of the temporary flexibilities introduced during the COVID-19 public health emergency are still in effect, but only for a limited time.

Here’s what providers and billing teams need to know about the current changes and extended policies:

Telehealth Flexibilities Extended Through September 30, 2025

Many of the telehealth waivers and billing flexibilities that began during the pandemic are still active. Under the Consolidated Appropriations Act (CAA), Medicare will continue reimbursing for a broad range of telehealth services until at least September 30, 2025.

More Providers Can Now Bill Medicare for Telehealth

Medicare has expanded the list of eligible providers who can offer and bill for telehealth services. This now includes:

- Occupational Therapists (OTs)

- Speech-Language Pathologists (SLPs)

- Physical Therapists (PTs)

- Audiologists

Audio-Only Telehealth Is Still Covered For Now

Medicare will continue covering audio-only telehealth services, especially for:

- Mental health services

- Certain Evaluation & Management (E/M) visits

Key modifiers still apply:

- Modifier FQ for audio-only mental health visits

- Modifier 93 for approved E/M and therapy codes delivered via telephone

How We Help: Expert Medicare Telehealth Billing Services

Dealing with Medicare telehealth billing in 2025 isn’t easy. With evolving rules around POS codes, modifiers, and covered services, even a small mistake can mean denied claims, delayed payments, or worse, an audit.

At CloudRCM, we specialize in Medicare-compliant telehealth billing services tailored to your practice’s needs. Whether you’re a solo provider or a growing group practice, we take the stress out of billing so you can stay focused on what matters: delivering care.

Schedule a free consultation today to learn how we can optimize your Medicare telehealth billing and boost your bottom line.

Final Thought

Medicare telehealth billing in 2025 presents both opportunity and risk. By understanding the rules, avoiding mistakes, and partnering with billing experts, you can protect your revenue and deliver care with confidence.

Don’t let denied claims slow you down. Trust a billing partner that understands Medicare telehealth inside and out.

FAQs

Which CPT codes are used for Medicare telehealth?

Common Medicare telehealth CPT codes include 99212–99215 for office visits, G2010–G2012 for virtual check-ins, and other specialty-specific codes listed by CMS.

Does Medicare cover telehealth for all providers?

Medicare covers telehealth services for eligible providers such as physicians, nurse practitioners, and therapists, following CMS telehealth rules.

Which CPT codes are used for Medicare telehealth?

Common Medicare telehealth CPT codes include 99212–99215 for office visits, G2010–G2012 for virtual check-ins, and other specialty-specific codes listed by CMS

What modifier is required for Medicare telehealth claims?

Medicare typically requires modifier 95 or FQ/FR (for audio-only) to indicate that the service was delivered via telehealth.

Are there location restrictions for Medicare telehealth?

As of recent CMS updates, Medicare telehealth can be provided to patients at home or in any location during the public health emergency and beyond for certain services.

Medical Billing

Medical Billing Medical Coding

Medical Coding Medical Audit

Medical Audit Provider Credentialing

Provider Credentialing Denial Management

Denial Management A/R Follow-up

A/R Follow-up Private Practice

Private Practice Patient Help Desk

Patient Help Desk Customized Reporting

Customized Reporting Out-of-Network Billing

Out-of-Network Billing Internal Medicine

Internal Medicine Pediatrics

Pediatrics Radiology

Radiology Surgery

Surgery Emergency Medicine

Emergency Medicine Anesthesiology

Anesthesiology Cardiology

Cardiology Orthopedic

Orthopedic Psychiatry

Psychiatry Dentistry

Dentistry OB-GYN

OB-GYN Family Medicine

Family Medicine