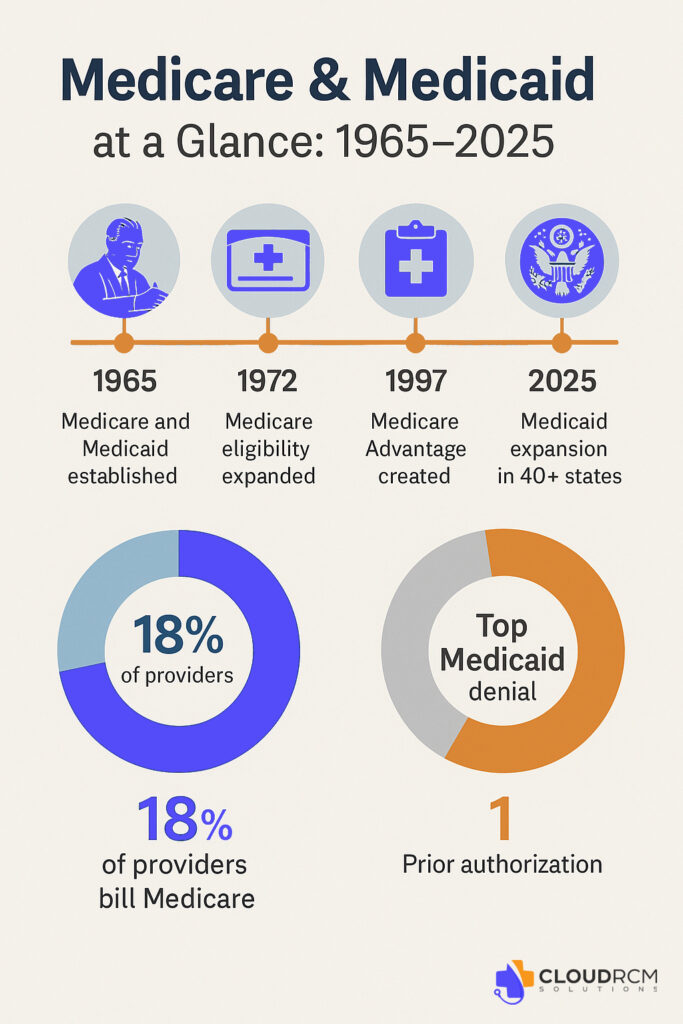

On July 30, 1965, President Lyndon B. Johnson signed into law two of the most transformative healthcare programs in U.S. history: Medicare and Medicaid. Sixty years later, these programs continue to serve as the backbone of American healthcare, supporting over 160 million beneficiaries combined and shaping the landscape for physicians, specialists, and healthcare practices across the nation.

At CloudRCM solutions, we’re proud to celebrate this milestone, and we’re here to help you make the most of your Medicare and Medicaid billing in 2025 and beyond.

A Brief History of Medicare & Medicaid

Before 1965, millions of older adults and low-income Americans had little to no access to affordable medical care. With the stroke of a pen, Medicare began providing health insurance for people aged 65 and older, regardless of income. At the same time, Medicaid offered a safety net to low-income families, pregnant women, children, seniors, and individuals with disabilities.

Fast forward to 2025, and both programs have evolved to cover:

- Medicare Part A & B: Hospital and outpatient services

- Medicare Advantage (Part C) and Part D: Managed care and prescription drugs.

- Medicaid Expansion: Now adopted by 40+ states, including California, to cover more adults.

- Special Programs: Such as Medi-Cal in California and Dual Eligibility coordination.

What This Anniversary Means for Today’s Providers

The 60th anniversary is more than a milestone; it’s a wake-up call for providers to examine how they engage with these essential programs. Whether you’re a physician, a clinic, a midwife, or a behavioral health provider, Medicare and Medicaid touch nearly every specialty.

But billing these programs isn’t simple.

Why is Medicare & Medicaid Billing So Complex?

Despite their importance, both programs come with a labyrinth of rules, payer-specific edits, and constantly changing regulations. Here’s why working with an expert billing team is essential:

Frequent Rule Changes

Each year, CMS releases updates to payment policies, CPT codes, and documentation standards. Missing even one update can result in denials or underpayments.

Strict Compliance Requirements

Billing Medicare/Medicaid improperly, even unintentionally, can result in audits, clawbacks, or worse, fraud allegations.

High Denial Rates

Especially with Medicaid Managed Care plans, it’s common to see denied claims due to authorization issues, eligibility mismatches, or incorrect modifiers.

Enrollment Delays

Getting credentialed or enrolled as a Medicare/Medicaid provider is time-consuming and full of red tape, something many providers overlook until it’s too late.

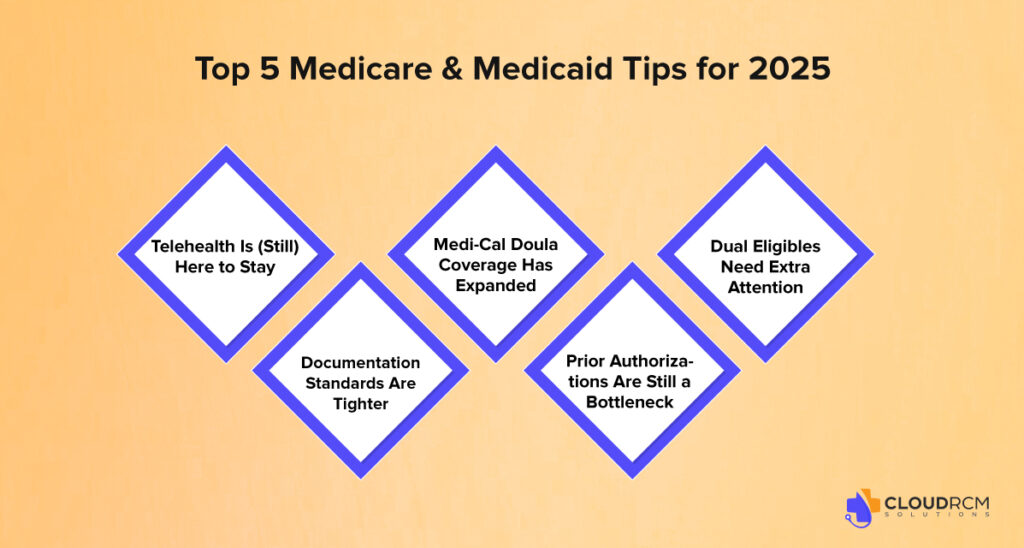

5 Things Every Provider Should Know About Medicare & Medicaid in 2025

To celebrate the program’s anniversary, here are five must-knows if you’re currently billing or thinking about billing Medicare or Medicaid.

Telehealth Is (Still) Here to Stay

Many of the telehealth flexibilities introduced during the COVID-19 public health emergency are still active, especially in Medicare Advantage and state Medicaid programs. But billing requirements differ by payer and state. Are you billing correctly?

Documentation Standards Are Tighter

2025 has seen new E/M guidelines and a push for value-based documentation. Sloppy or generic charting? You risk denials or audits.

Medi-Cal Doula Coverage Has Expanded

In California, Medi-Cal now pays for doula services. If you’re a doula or midwife, are you set up to bill? We can help you enroll, credential, and submit compliant claims.

Prior Authorizations Are Still a Bottleneck

Medicaid plans in particular often require prior authorization even for common procedures. Missing these steps delays payment.

Dual Eligibles Need Extra Attention

Billing for patients with both Medicare and Medicaid involves coordination of benefits, secondary billing, and careful tracking of allowable charges.

Why Outsourcing Your Medicare and Medicaid Billing Makes Sense

Let’s face it, billing Medicare and Medicaid in-house can quickly become overwhelming. Between the evolving regulations, payer-specific rules, and administrative burden, many practices find themselves losing valuable time and revenue.

If any of the following sound familiar, it may be time to consider outsourcing:

- You’re chasing unpaid claims or delayed reimbursements.

- You’re seeing frequent denials or rejections with little clarity.

- Your credentialing or enrollment status is unclear or out of date.

- You’re spending more time on admin tasks than patient care.

Why Choose CloudRCM for Medicare & Medicaid Billing Services?

If you bill Medicare or Medicaid, you already know it’s not as simple as sending a claim and waiting for a payment. These programs come with complex rules, frequent updates, and different requirements depending on the state and payer.

Schedule a free billing consultation with our Medicare/Medi-Cal experts

FAQs

How long does it take to get credentialed with Medicare or Medi-Cal?

Credentialing can take anywhere from 30 to 90 days, depending on the payer and whether your documentation is complete. We improve the process to avoid delays.

Can I still bill Medicare for telehealth in 2025?

Yes, many telehealth flexibilities are still in place for 2025, especially under Medicare Advantage. However, billing rules and eligible codes vary by state and plan. We help ensure compliance.

What if I miss a prior authorization for a Medicaid service?

Unfortunately, many Medicaid MCOs will deny the claim outright. We track prior auths and help appeal denials when possible to recover revenue.

Medical Billing

Medical Billing Medical Coding

Medical Coding Medical Audit

Medical Audit Provider Credentialing

Provider Credentialing Denial Management

Denial Management A/R Follow-up

A/R Follow-up Private Practice

Private Practice Patient Help Desk

Patient Help Desk Customized Reporting

Customized Reporting Out-of-Network Billing

Out-of-Network Billing Internal Medicine

Internal Medicine Pediatrics

Pediatrics Radiology

Radiology Surgery

Surgery Emergency Medicine

Emergency Medicine Anesthesiology

Anesthesiology Cardiology

Cardiology Orthopedic

Orthopedic Psychiatry

Psychiatry Dentistry

Dentistry OB-GYN

OB-GYN Family Medicine

Family Medicine