Home health agencies are entering 2026 under extreme reimbursement pressure. Home health claim denial rates are at a seven-year high as CMS audits, Medicaid redeterminations, Medicare Advantage scrutiny, and payer-specific billing rules continue to tighten. Even minor documentation or coding errors are now enough to trigger denials, delayed payments and increased audit exposure.

More than 31% of home health claims are delayed or denied, largely due to preventable issues such as incorrect CPT coding, conflicting nursing and therapy documentation, missing signatures, and payer-specific compliance gaps. In 2026, successful home health billing depends on documentation accuracy, coding precision, and payer-aligned RCM workflows; anything less puts revenue, compliance, and operational stability at risk.

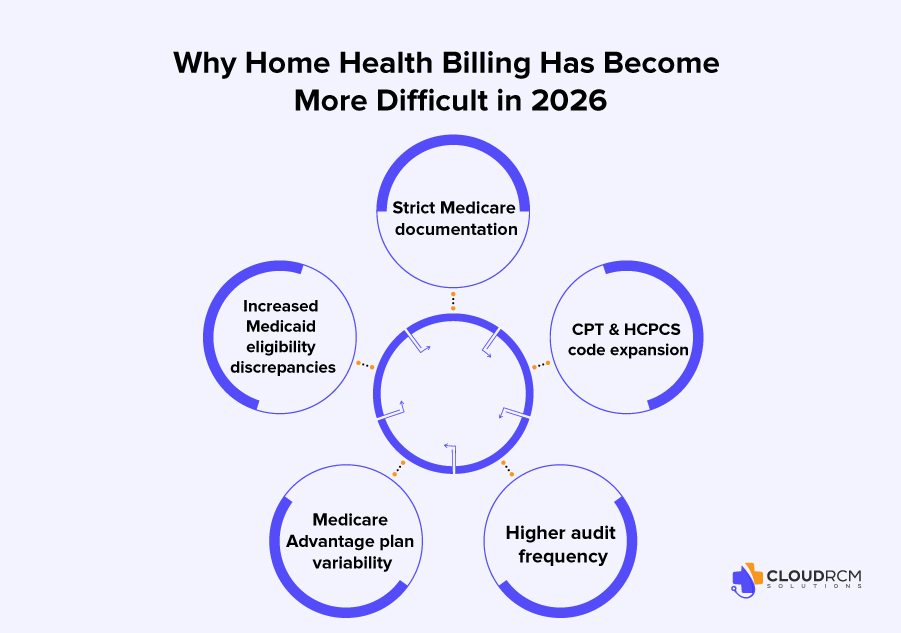

Why Home Health Billing Has Become More Difficult in 2026?

Home health billing complexity has steadily increased between 2024 and 2026 due to a combination of regulatory changes, payer behavior, and heightened audit activity. Medicare documentation requirements have become far stricter, leaving little room for error. Homebound status, skilled need, plan of care updates, and visit documentation must align perfectly. Even a single missing element can result in a full claim denial rather than a partial adjustment.

At the same time, Medicaid eligibility has become more unpredictable. States such as Texas, Florida, and California frequently revise managed care structures, creating coverage gaps and confusion around authorizations. CPT and HCPCS code expansion has added another layer of difficulty, especially for therapy, nursing, wound care, and telehealth services, where modifiers and payer-specific rules must be applied accurately.

Medicare Advantage plans have added yet another challenge. Each MA plan operates under its own documentation standards, submission timelines, and authorization rules, making standardized workflows difficult for agencies managing multiple payers. Combined with an increase in TPE audits, recovery audits, and pre-payment reviews, many home health practices are realizing that traditional in-house billing models are no longer sufficient. As a result, more agencies are turning to outsourced billing partners to stay compliant and reduce administrative strain.

What’s Driving Home Health Reimbursement Pressure in 2026?

1. Senior Population Growth

The aging population is expanding rapidly, particularly in states like Florida, California, Texas, and Arizona. As more seniors rely on home health services, agencies are delivering more visits, managing more care plans, and generating more documentation. Without precise coding and airtight documentation, higher volume directly translates into higher denial risk.

2. Medicaid Expansion Variability

Medicaid remains one of the most complex payers for home health agencies because each state defines its own coverage rules. Practices are dealing with frequent eligibility interruptions, strict prior authorization requirements, and shifting service limits that change mid-year. These inconsistencies make it easy for otherwise valid claims to be denied.

3. Medicare Advantage dominance

Medicare Advantage plans now deny home health services at nearly two and a half times the rate of traditional Medicare. Common denial reasons include missing homebound documentation, weak skilled nursing justification, and delayed therapy recertifications. These denials often occur even when care is clinically appropriate.

4. Higher scrutiny on therapy services

Physical therapy, occupational therapy, and speech therapy services are under intense review, especially in California, Texas, Illinois, and New York. Auditors closely examine frequency, duration, and medical necessity, making therapy documentation a high-risk area for agencies.

5. New CPT code updates

Ongoing CPT updates related to therapy, wound care, infusion services, and telehealth require agencies to apply correct coding logic and modifiers. Even experienced billing teams can struggle to keep up without dedicated coding expertise.

Geographic Trends in Denials

- Texas: Large Medicaid population, strict managed care documentation requirements, high Medicare Advantage denial volumes

- California: Increased audits, prior authorization issues, Medi-Cal coverage interruptions

- Florida: High senior population, therapy service reliance, denied Medicaid claims due to incomplete or outdated care plans

- New York: Strict documentation rules, aggressive MLTC plan oversight

- Illinois: Documentation-related denials doubled since 2024 due to growing Medicare Advantage enrollment.

These trends highlight why accurate CPT coding, precise documentation, and proactive RCM workflows are no longer optional.

Critical Home Health Billing Components

Here are the billing components that create the most trouble for home health practices:

1. Eligibility Verification & Insurance Coverage

Eligibility verification is one of the most critical and most overlooked steps in home health billing. A single error, such as an outdated Medicaid status or an expired authorization, can delay payment for months.

This affects;

- Therapy services

- Nursing assessments

- Personal care

- Home visits

- Chronic care services

- Telehealth (varies by payor)

Medicare requires confirmation of homebound status, skilled need, a valid plan of care, and physician certification. At the same time, Medicaid coverage varies widely by state and often requires prior authorization for most services.

2. CPT Coding Challenges

Home health billing involves multiple CPT categories, including home visit codes, therapy codes, nursing services billed through G-codes or bundled visits, and telehealth services. Each payer reimburses these services differently, and incorrect modifiers, add-on code errors, or place-of-service mistakes remain some of the most common denial triggers.

3. Documentation Requirements

Documentation is where most home health claims fail. Unlike clinic billing, home health requires clear proof of homebound status and medical necessity.

Auditors look for:

- Clear documentation of why the patient cannot leave home

- Evidence of skilled services (PT, OT, nursing)

- Plan of care timelines

- Signatures and dates

- Progress notes that match CPT codes

Missing any one of these elements can invalidate the entire claim.

4. Frequent Denial Categories

Home health agencies repeatedly see denial codes such as CO-197 for non-covered services, CO-50 for lack of medical necessity, CO-29 for timely filing issues, and CO-16 for incorrect or missing information. Preventing these denials requires a combination of eligibility checks, accurate coding, internal audits, and clean documentation practices.

Essential Home Health Codes and Modifiers

Skilled Nursing (RN/LPN)

| CPT / HCPCS Code | Description |

| G0299 | Direct skilled nursing services by a Registered Nurse (RN) in 15-minute increments |

| G0300 | Direct skilled nursing services by a Licensed Practical Nurse (LPN) in 15-minute increments |

| G0162 | Skilled services by an RN for management and evaluation of the plan of care |

| G0493 | Observation and assessment of a patient’s condition by an RN |

Therapy Services (PT/OT/SLP)

| CPT / HCPCS Code | Description |

| G0151 | Physical therapy services by a qualified physical therapist |

| G0152 | Occupational therapy services by a qualified occupational therapist |

| G0153 | Speech-language pathology services |

| G0157 / G0158 | Services performed by physical or occupational therapy assistants |

Evaluation and Management (E/M)

| CPT / HCPCS Code | Description |

| 99341–99345 | Home or residence services for a new patient, ranging from straightforward to high complexity |

| 99347–99350 | Home or residence services for an established patient |

Aide & Social Services

| CPT / HCPCS Code | Description |

| G0156 | Services of a home health aide in 15-minute increments |

| G0155 | Services of a clinical social worker under a plan of care |

Therapy-Specific Modifiers

| Modifier | Description |

| GP | Services delivered under an outpatient physical therapy plan of care |

| GO | Services delivered under an outpatient occupational therapy plan of care |

| GN | Services delivered under an outpatient speech-language pathology plan of care |

| CQ / CO | Required when physical therapy (CQ) or occupational therapy (CO) assistant services are provided in whole or in part |

Telehealth Modifiers

| Modifier | Description |

| 95 | Synchronous telemedicine service rendered via a real-time audio and video system |

| 93 | Synchronous telemedicine service rendered via audio-only technology |

| FQ | Used by FQHCs/RHCs for audio-only telehealth services |

General Modifiers

| Modifier | Description |

| 25 | Significant, separately identifiable E/M service by the same physician on the same day as a procedure |

| 59 | Distinct procedural service, used to identify services that are not normally reported together but are appropriate under the circumstances |

2026 CMS Updates & Their Impact on Home Health Practices

Medicare (CMS) 2026 Impacts

CMS changes for 2026 include payment reductions, stricter thresholds for skilled service qualification, expanded prior authorization requirements in certain states, increased recertification documentation demands, and revised oversight for RPM and telehealth services.

What This Means for Home Health Practices

These updates translate into more rejected claims, increased pre-payment audits, longer reimbursement timelines, and a heavier documentation burden. Practices that lack strong compliance workflows will struggle to maintain cash flow, making AI-driven coding and documentation checks increasingly essential.

Target Specialties Supported by Home Health Billing

CloudRCM Solutions supports a wide range of home-based specialties:

- Home Health Nursing

- Physical Therapy (PT)

- Occupational Therapy (OT)

- Speech Therapy (ST)

- Medical Social Work

- Home-Based Primary Care

- Wound Care Providers

- Chronic Disease Management Providers

- Palliative Care & Hospice Affiliates

- Behavioral Health Providers offering home visits

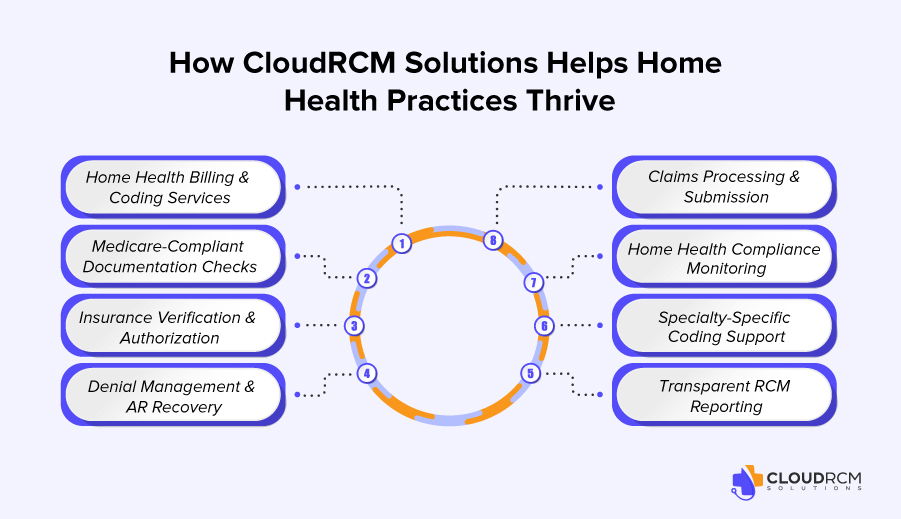

How CloudRCM Solutions Helps Home Health Practices Thrive in 2026

CloudRCM Solutions delivers end-to-end home health billing and coding services designed to meet 2026 compliance standards. Our team ensures accurate CPT and HCPCS usage across nursing, therapy, and wound care services while performing Medicare-compliant documentation checks that verify homebound status, skilled need, and plan-of-care alignment.

We manage insurance verification and authorization across Medicare, Medicaid, managed care, and commercial plans, aggressively handle denial management and AR recovery, and follow a clean-claim submission approach to accelerate reimbursements. Built-in compliance monitoring keeps agencies aligned with CMS, Medicare Advantage, and state-level regulations, while specialty-specific coding expertise reduces audit risk. Transparent RCM reporting provides visibility into KPIs, denial trends, and cash flow.

The “2026-Proof” Advantage of Working With CloudRCM Solutions

Partnering with CloudRCM Solutions helps home health practices lower denials, speed up reimbursements, and navigate complex state-specific rules in markets like California, Texas, Florida, New York, Illinois, and Arizona. Our Medicare Advantage expertise minimizes payment interruptions, while precise CPT and modifier accuracy reduces audit exposure. With an AI-powered RCM backbone and scalable billing support, agencies can grow confidently whether managing 20 patients or 2,000.

Conclusion:

Home health demand is rising, but reimbursement pressure is increasing faster. Documentation gaps, coding inaccuracies, eligibility errors, and delayed submissions are major revenue risks. Practices that succeed will strengthen documentation, modernize workflows, adopt AI-enhanced RCM, and partner with a dedicated home health billing team like CloudRCM Solutions.

Medical Billing

Medical Billing Medical Coding

Medical Coding Medical Audit

Medical Audit Provider Credentialing

Provider Credentialing Denial Management

Denial Management A/R Follow-up

A/R Follow-up Private Practice

Private Practice Patient Help Desk

Patient Help Desk Customized Reporting

Customized Reporting Out-of-Network Billing

Out-of-Network Billing Internal Medicine

Internal Medicine Pediatrics

Pediatrics Radiology

Radiology Surgery

Surgery Emergency Medicine

Emergency Medicine Anesthesiology

Anesthesiology Cardiology

Cardiology Orthopedic

Orthopedic Psychiatry

Psychiatry Dentistry

Dentistry OB-GYN

OB-GYN Family Medicine

Family Medicine