This holiday, give your practice the gift of financial clarity and recovered revenue.

Thanksgiving is a season of gratitude, reflection, and fresh starts. As healthcare providers pause to appreciate patients, staff, and another year of service, there’s something else worth being thankful for: the hidden revenue sitting in old claims, aging A/R, and unresolved denials.

And yet, across the U.S., thousands of practices are unknowingly leaving money on the table.

More than 15–30% of medical claims are underpaid, delayed, or never reimbursed.

Over $262 billion in healthcare claims become “stuck” in aged A/R every year (MGMA).

Some states, like Texas, Florida, California, New York, and Georgia, experience the highest rates of payer denials and slow reimbursements.

This Thanksgiving, Cloud RCM Solutions is offering practices a seasonal opportunity to recover revenue from old claims without disrupting holiday operations.

Why Thanksgiving Is the Perfect Time to Recover Lost Revenue

The end of the year brings:

- insurance changes

- deductible resets

- payer policy updates

- staffing shortages

- increased patient visits

It’s also when practices notice something alarming

Their aging A/R has quietly grown all year.

Thanksgiving is more than a holiday; it’s a checkpoint.

A moment to reset your revenue cycle before January brings a new storm of claims.

End-of-Year Revenue Reality

Across the nation, practices report:

- 18–34% increase in unpaid claims between October and December

- Longer payer processing delays due to holiday staffing gaps

- Higher patient volume, but lower collection rates

- Spike in eligibility-related denials as insurance policies renew

When left unnoticed, old claims transition into:

- lost revenue

- timely filing denials

- unrecoverable balances

- cash-flow gaps entering the New Year

Thanksgiving becomes the strategic moment to clean up, correct, and collect.

Understanding Why Old Claims Pile Up

Old claims don’t happen by accident; they happen because the system breaks down in predictable ways.

1. High Denial Rates in Certain States

States like California, Texas, Florida, New Jersey, and Pennsylvania experience:

- Higher payer denial ratios

- more strict documentation requirements

- aggressive downcoding

- inconsistent payer guidelines

Practices in these regions often carry 30–45% more aged A/R than practices in low-denial states.

2. Speciality Groups Hit the Hardest

Some specialities face the steepest losses from aged claims:

| Specialty | Common Revenue Loss Issues |

| Emergency Medicine | High-volume coding errors, downcoding, payer “not medically necessary” denials |

| Primary Care & Pediatrics | Eligibility errors, coordination of benefits issues |

| Mental/Behavioral Health | Lack of documentation specificity, authorization denials |

| Pain Management | Injection/bundling denials, pre-auth failures |

| Cardiology | High-cost procedure audits, modifier confusion |

| Urgent Care | POCT, global billing conflicts, payer edits |

| Physical Therapy & Rehab | Visit-limit denials, medical necessity challenges |

These specialties often leave 20–40% of revenue in aged claims, especially during holidays when admin teams are short-staffed.

3. Payer Policy Shifts Before the New Year

Insurance companies like UnitedHealthcare, Blue Cross, Aetna, Cigna, Medicaid MCOs update:

- coding guidelines

- coverage criteria

- prior authorization rules

- CMS alignment policies

If your billing team misses even one adjustment, the claim may drift into the “old claims” category.

4. Staffing Gaps During November–December

With holidays, PTO, and scheduling gaps:

- Claim follow-ups slow down

- denials go unworked

- appeals are delayed

- Documentation requests pile up

This creates a wave of aging A/R that practices notice too late.

Are You Losing Revenue to Old Claims?

Most practices don’t realize how much money is stuck in their A/R until they run a breakdown like:

- 0–30 days

- 30–60 days

- 60–90 days

- 90–120 days

- 120+ days

Industry benchmarks show that:

- Every day after 90 days, the chance of reimbursement drops by 12–18%

- After 120 days, over 80% of claims are NEVER recovered.

If you haven’t reviewed your old claims by Thanksgiving, chances are:

- Your cash flow is being artificially deflated

- You’re absorbing losses that payers owe you

- You’re carrying unnecessary bad debt

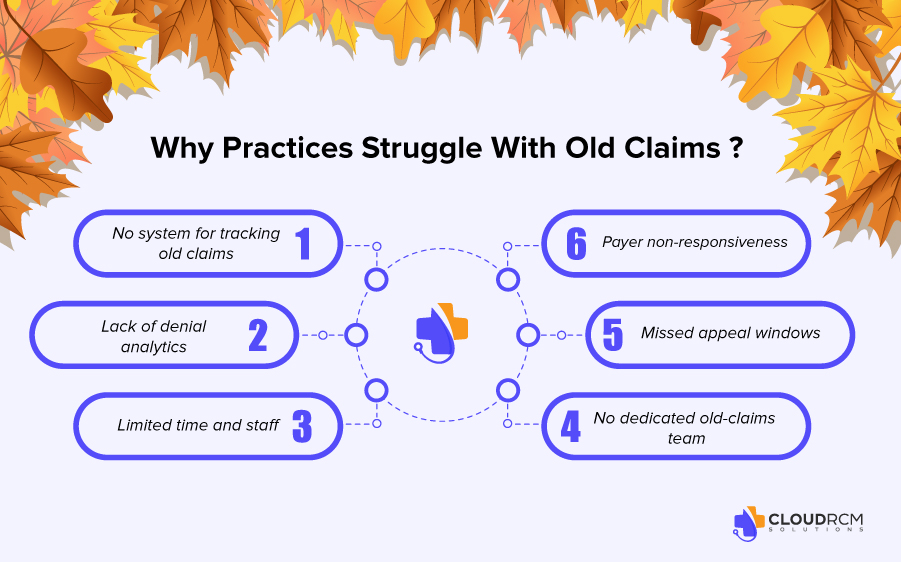

Why Practices Struggle With Old Claims?

Here are the core issues that prevent providers from recovering aged A/R:

- No system for tracking old claims

Many practices only focus on fresh claims.

- Lack of denial analytics

Without data, you can’t see patterns.

- Limited time and staff

Your internal team is built for daily claims, not backlog recovery.

- Payer non-responsiveness

Some payers like UHC & Medicaid MCOs delay communication.

- Missed appeal windows

Many practices don’t have a structured appeal calendar.

- No dedicated old-claims team

Backlogs require specialized RCM skills not just general billing.

What You CAN Do!

Here’s what practices typically need to do:

1. Audit Your Aged Claims

Look for:

- top denial categories

- patterns in payer behavior

- errors in coding or modifiers

2. Segment High-Value Claims

Examples:

- 99284, 99285 (ED)

- infusion therapies

- DME claims

- outpatient surgery claims

3. Identify Claims With Recoverable Potential

Look for:

- appeals possible

- payer recouping incorrectly

- missing documentation

4. Update Payer Info Before Reworking

Payers often change addresses, portals, and rules after October.

5. Rebill, Appeal, or Escalate

But the strategy varies by payer and denial type.

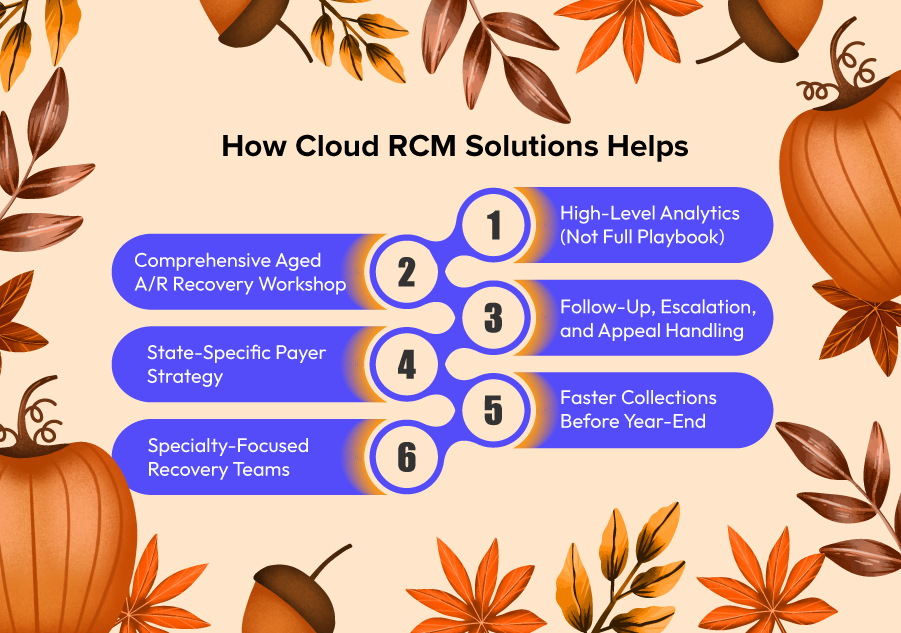

How Cloud RCM Solutions Helps

Cloud RCM Solutions specializes in recovering lost revenue stuck in old claims especially during end-of-year months when practices need cash flow.

Here’s what we bring to the table:

Comprehensive Aged A/R Recovery Workshop

We analyze:

- aged claims

- denials

- underpayments

- silent PPO reductions

- coding discrepancies

97% of practices discover revenue they didn’t know they were missing.

State-Specific Payer Strategy

We tailor recovery based on state-level trends:

- Florida → high eligibility denials

- Texas → pre-auth issues

- California → bundling conflicts

- New York → coding audits

- Georgia → modifier denials

Specialty-Focused Recovery Teams

Our teams specialize in:

- emergency medicine

- urgent care

- mental health

- orthopedics

- pain management

- PT/OT

- cardiology

Each specialty has different recovery patterns and we treat them accordingly.

High-Level Analytics (Not Full Playbook)

We identify:

- Recoverable balances

- Payer behavior patterns

- Top loss areas

- Coding or documentation errors

Follow-Up, Escalation, and Appeal Handling

We pursue:

- Corrected claims

- Reprocessing

- Appeals

- Medical record submissions

- High-level payer escalations

But the exact workflow is proprietary.

Faster Collections Before Year-End

Our goal is simple:

Recover as much lost revenue as possible before January 1st.

This helps practices enter the new year with:

- Strong cash flow

- clean A/R

- stabilized revenue cycle

Thanksgiving Message!

As you celebrate Thanksgiving, grateful for your patients, your team, and the ability to serve, don’t forget the revenue your practice has already earned but not yet collected.

Old claims hold more value than most practices realize.

Cloud RCM Solutions is here to help you:

- Recover lost revenue

- Stabilize your cash flow.

- clear aged A/R

- Enter the new year stronger

Thanksgiving Offer:

A complimentary Aged A/R Review for practices wanting to recover old claims before year-end.

Ready to recover lost revenue from old claims this Thanksgiving?

Let Cloud RCM Solutions help you find and collect the money you’ve already earned.

Contact us today to claim your Thanksgiving Revenue Recovery Review.

FAQs

Why do old medical claims go unpaid or get stuck in aged A/R?

Old claims usually get stuck due to coding errors, missing documentation, eligibility issues, payer policy changes, or lack of timely follow-up. Many practices only work new claims, allowing older ones to age out unnoticed.

Can old claims still be recovered after 90 or 120 days?

Yes, many claims can still be appealed or reprocessed beyond 90–120 days, depending on payer rules. Medicare, Medicaid, and commercial plans each have different timelines, but recoverable revenue exists even in older buckets.

What types of claims recover the most revenue when revisited?

High-value CPTs (99284–99285), injections, imaging, urgent care codes, surgical procedures, and high-volume E/M claims often yield the highest recovery when corrected and resubmitted.

Which specialties lose the most revenue to aged claims?

Emergency medicine, urgent care, cardiology, orthopedics, pain management, and behavioral health typically face the most denials and aged A/R due to coding complexity and strict payer rules.

Medical Billing

Medical Billing Medical Coding

Medical Coding Medical Audit

Medical Audit Provider Credentialing

Provider Credentialing Denial Management

Denial Management A/R Follow-up

A/R Follow-up Private Practice

Private Practice Patient Help Desk

Patient Help Desk Customized Reporting

Customized Reporting Out-of-Network Billing

Out-of-Network Billing Internal Medicine

Internal Medicine Pediatrics

Pediatrics Radiology

Radiology Surgery

Surgery Emergency Medicine

Emergency Medicine Anesthesiology

Anesthesiology Cardiology

Cardiology Orthopedic

Orthopedic Psychiatry

Psychiatry Dentistry

Dentistry OB-GYN

OB-GYN Family Medicine

Family Medicine