Ambulatory Surgery Center (ASC) billing plays a critical role in ensuring fast reimbursements, compliance, and profitability. In 2023, over 6,300 Medicare-certified ASCs performed more than 6.4 million Medicare fee-for-service procedures, with outpatient surgical demand rising steadily. While ASCs offer cost-effective, same-day care, billing remains complex—bundled payments, strict coding rules, and multiple payer guidelines can quickly impact revenue.

This guide covers the essentials of ASC medical billing, key challenges that affect payments, and how expert billing support helps ASCs boost revenue and stay compliant.

What is ASC Billing and Why Is It Important?

Ambulatory Surgery Center (ASC) billing refers to the process of submitting and managing insurance claims for services performed at Ambulatory Surgery Centers facilities that provide outpatient surgical care without overnight stays. It’s a critical part of the revenue cycle that ensures ASCs get paid accurately and on time.

Why is it crucial? Because ASC billing is more than just codes and claims, it’s about staying compliant with payer rules, minimizing denials, and maximizing reimbursement.

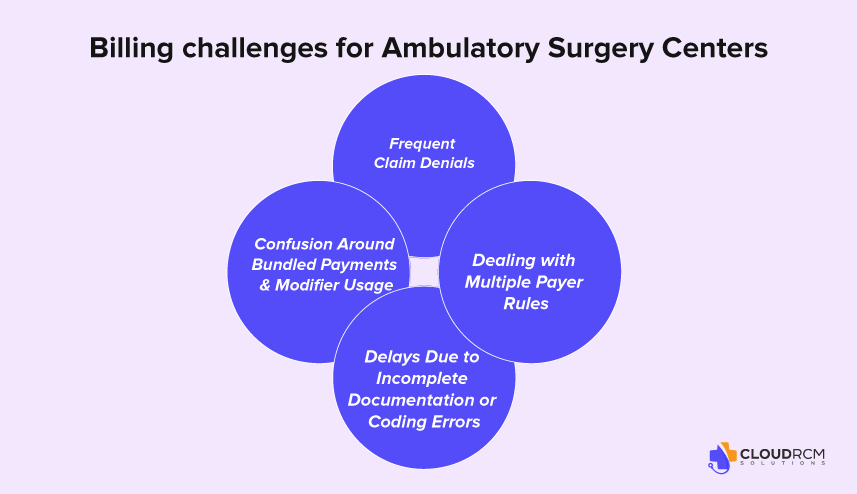

Common Ambulatory Surgery Center Billing Challenges

Even the most efficient Ambulatory Surgery Centers face ongoing billing challenges that can disrupt cash flow, increase denials, and delay payments. Below are some of the most frequent issues that impact ASC billing, and how your center can stay ahead of them.

Frequent Claim Denials

One of the most common issues in ASC billing is claim denials, often caused by missing information, incorrect coding, or lack of prior authorization. Denials don’t just slow down reimbursement; they create additional administrative work and lost revenue if not appealed promptly.

How to reduce them:

- Perform eligibility and benefits checks before procedures

- Implement real-time claim scrubbing

- Monitor denial trends and create feedback loops with coding staff

Confusion Around Bundled Payments & Modifier Usage

ASCs often deal with bundled payments, especially for procedures that involve implants, anesthesia, and multiple services in one session. Misunderstanding what’s included in the bundle or failing to use the correct modifiers can result in underpayment or full claim rejection.

Tips to stay compliant:

- Review payer-specific bundling rules regularly.

- Use ASC-specific modifiers (like -51, -59, -SG) correctly.

- Cross-train coders on Medicare and commercial billing logic.

Dealing with Multiple Payer Rules

Medicare and commercial insurers often follow very different rules when it comes to ASC reimbursement. For example, Medicare uses a fixed ASC Payment Group system, while commercial payers may require different authorization or documentation standards.

Proactive strategies:

- Maintain up-to-date payer policy guides

- Verify requirements during patient intake.

- Use software or clearinghouses that flag payer-specific edits

Delays Due to Incomplete Documentation or Coding Errors

Even minor documentation gaps like missing operative reports or mismatched diagnosis codes can lead to claim delays or outright rejections. Coding errors are especially risky in ASCs due to the high volume of procedures and strict compliance requirements.

Solutions:

- Require checklists for clinical documentation before claim submission.

- Conduct routine coding audits.

- Invest in ongoing coder training and CEUs

Medicare vs. Commercial Payers: Key Differences in ASC Billing

Understanding the differences between Medicare and commercial payer billing is essential for Ambulatory Surgery Centers (ASCs) to avoid underpayments, rejections, and costly delays. Each payer type has its own set of billing rules, reimbursement methods, and documentation expectations. Here’s how they compare:

How Medicare Reimburses ASCs

Medicare uses a fixed-rate system to reimburse ASCs based on Ambulatory Payment Classifications (APCs) under the Outpatient Prospective Payment System (OPPS). Each covered procedure is assigned to an ASC Payment Group (APG), which determines how much the facility is paid, regardless of what was spent.

Key Medicare billing facts:

- Medicare covers only procedures on the ASC Covered Procedures List

- Pays 80% of the ASC rate; patients are responsible for the remaining 20% (unless they have secondary insurance)

- Requires specific modifiers and facility-level coding

Commercial Payer Billing: More Flexibility, More Variability

Commercial insurance plans (like Aetna, Cigna, BCBS, UnitedHealthcare) typically offer higher reimbursement rates than Medicare, but they also come with greater complexity. Each payer may have its own:

- Fee schedules

- Authorization protocols

- Bundling rules (especially for implants, anesthesia, and same-day procedures)

Prior Authorization Requirements:

While Medicare generally does not require prior authorization for most ASC procedures, commercial payers almost always do, and failure to secure it can result in a complete denial, no matter how accurate the coding is.

Understanding the Place of Service (POS) in ASC Billing

When billing for procedures performed in an Ambulatory Surgery Center, using the correct Place of Service (POS) code is critical for claim approval and accurate reimbursement. The designated POS code for ASCs is “24”, which specifically identifies services rendered in a freestanding surgical facility.

Using anything other than POS 24 can trigger denials, reimbursement delays, or even payer audits, especially with Medicare and commercial insurers who rely on this code to determine payment rates and coverage policies.

How to Improve ASC Billing and Get Paid Faster

Efficient billing is the backbone of a financially healthy Ambulatory Surgery Center. When done right, it minimizes claim denials, improves cash flow, and helps your team stay focused on patient care, not paperwork. Below are proven Ambulatory Surgery Center (ASC) billing best practices to help your facility stay ahead.

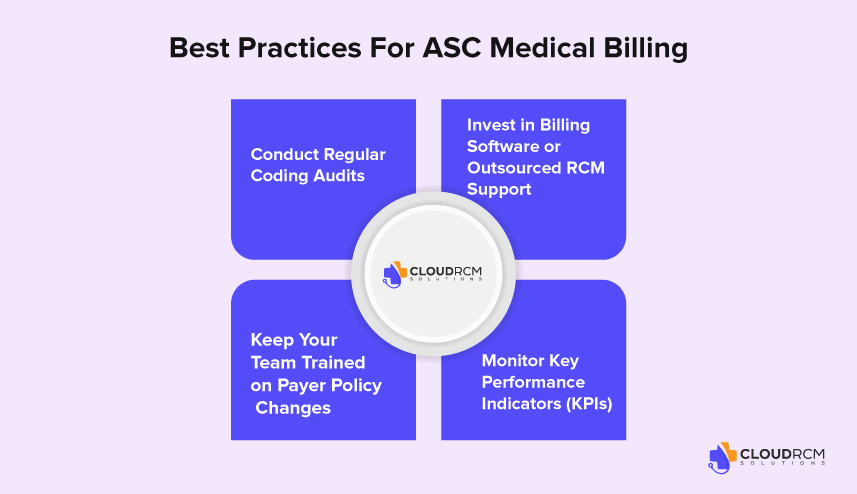

Conduct Regular Coding Audits

Even a small coding error can lead to denied claims or compliance issues. Regular internal or third-party coding audits help identify mistakes before they impact reimbursement. Audits are especially important when CPT or payer guidelines change.

Invest in Billing Software or Outsourced RCM Support

Manual billing processes increase the risk of errors, missed deadlines, and inconsistent follow-up. Investing in reliable billing software or partnering with an experienced RCM company for ASCs can streamline claims, speed up payments, and reduce administrative stress.

Keep Your Team Trained on Payer Policy Changes

Payer rules can change without warning, and what worked last month may no longer apply. Continuous staff training ensures your team stays current on authorization requirements, modifier rules, and documentation standards.

Monitor Key Performance Indicators (KPIs)

You can’t improve what you don’t measure. Track essential billing KPIs like:

- Clean claim rate (goal: 95%+)

- Days in A/R (goal: under 35 days)

- Denial rate (goal: under 5%)

How Outsourced Billing Helps ASCs Thrive

Managing billing in-house can overwhelm even the most efficient Ambulatory Surgery Centers. With evolving payer rules, tight margins, and staffing challenges, many ASCs are turning to outsourced ASC billing services for more control and better results. Here’s how expert support can make a measurable difference:

Fewer Denials, Faster Payments

A reliable billing partner knows how to minimize errors before claims are sent. Through real-time claim scrubbing, payer-specific edits, and aggressive denial management, outsourced teams help reduce claim denials and accelerate your reimbursement cycle.

Access to ASC Billing Specialists

Your team wears many hats, but billing experts focus 100% on accuracy, compliance, and follow-up. With an outsourced partner, you gain access to certified coders, denial specialists, and professionals who stay up to date on Medicare, Medicaid, and commercial payer guidelines.

Scalable Support for Growing Centers

Whether you’re expanding to multiple locations or adding new specialties, outsourced ASC RCM companies offer flexible, scalable support that grows with your needs. No need to hire or train additional staff; instead, your billing partner adjusts to your volume and complexity.

CMS Billing Guidelines & Regulatory Compliance

Staying compliant with CMS ASC billing guidelines is non-negotiable for Ambulatory Surgery Centers that serve Medicare patients. CMS regulates everything from what procedures ASCs can perform to how those services should be billed, coded, and reimbursed.

Key Medicare Billing Compliance Areas for ASCs:

ASC Covered Procedures List (CPL):

ASCs can only bill Medicare for procedures approved and listed on the ASC Covered Procedures List. Submitting claims for non-approved procedures leads to automatic denials.

Correct Use of Modifiers & NCCI Edits:

ASCs must follow National Correct Coding Initiative (NCCI) edits, which prevent improper billing combinations. Modifiers like -59, -51, and -SG must be used correctly to avoid underpayment or rejection.

CMS ASC Payment Group (APG) Assignments:

Every Medicare-approved procedure is tied to an ASC Payment Group (APG), which determines reimbursement. Misreporting CPT codes can place your claim in the wrong payment tier.

Quarterly CMS Updates:

CMS releases quarterly updates that affect payment rates, coding edits, and procedure coverage. Failing to apply these changes promptly can result in compliance issues or financial losses.

Routine Compliance Audits:

Medicare billing compliance for ASCs includes regular internal or third-party audits to catch improper claims, documentation gaps, or modifier misuse before an external payer audit flags them.

California ASC Billing & Medi-Cal Reimbursement Guidelines

Ambulatory Surgery Centers (ASCs) in California face unique billing challenges, especially when working with Medi-Cal, the state’s Medicaid program. Unlike Medicare, Medi-Cal reimbursement rates are often lower, and approval for certain procedures may require additional pre-authorization and documentation.

Key California-specific considerations:

- Enrollment with DHCS: ASCs must be enrolled as providers with the California Department of Health Care Services (DHCS) to bill Medi-Cal.

- Medi-Cal Manual Pricing: Some ASC procedures are not listed on the Medi-Cal fee schedule and may be subject to manual pricing, leading to payment delays if documentation is incomplete.

- Medical Necessity Rules: ASCs must provide strong clinical justification for many outpatient surgeries to be covered under Medi-Cal.

Final Thought

Ambulatory Surgery Center billing doesn’t have to be a daily struggle. With the right strategy and expert support, your ASC can run smoother, collect faster, and stay compliant no matter how complex the rules get. CloudRCM is here to make billing one less thing to worry about.

Let CloudRCM Handle the Billing, So You Can Focus on Surgery

At CloudRCM, we specialize in outsourced ASC billing designed to fit the unique needs of ambulatory surgery centers. Our expert team handles everything from claim submission to denial management, freeing up your staff and improving your bottom line.

Whether you’re looking to fix revenue leaks, improve compliance, or scale your operations, we’re here to help.

Schedule an appointment today at (224) 231-6880 to discover how outsourced ASC billing can transform your practice.

Source:

6,300+ ASCs performed 6.4M+ Medicare procedures in 2023 (MedPAC).

FAQs

What is ASC billing?

ASC billing refers to submitting claims for outpatient surgical procedures performed in an Ambulatory Surgery Center.

Who bills for services in an ASC?

Both the facility (ASC) and the individual surgeon may submit separate claims.

What codes are used in ASC billing?

HCPCS/CPT codes for procedures and CMS-approved ASC payment codes are used.

What form is used to submit ASC claims?

ASC facility claims are submitted using the CMS-1500 form.

Are ASCs reimbursed under a specific payment system?

Yes, Medicare reimburses ASCs under the ASC Payment System

Medical Billing

Medical Billing Medical Coding

Medical Coding Medical Audit

Medical Audit Provider Credentialing

Provider Credentialing Denial Management

Denial Management A/R Follow-up

A/R Follow-up Private Practice

Private Practice Patient Help Desk

Patient Help Desk Customized Reporting

Customized Reporting Out-of-Network Billing

Out-of-Network Billing Internal Medicine

Internal Medicine Pediatrics

Pediatrics Radiology

Radiology Surgery

Surgery Emergency Medicine

Emergency Medicine Anesthesiology

Anesthesiology Cardiology

Cardiology Orthopedic

Orthopedic Psychiatry

Psychiatry Dentistry

Dentistry OB-GYN

OB-GYN Family Medicine

Family Medicine