AR is the Bottleneck, and Most Practices Are Still Stuck in the Slow Lane. Medical practices work hard, treat patients daily, and submit claims on time, yet payments still drag. Why? Accounts Receivable in medical billing is where revenue gets delayed, denied, or forgotten.

In today’s healthcare environment, every single day in DAR matters. High Days in Accounts Receivable (DAR) affects payroll, operational stability, and a practice’s ability to invest in staff, technology, and patient care.

National data shows that most practices have 35–55 Days in AR, while MGMA reports that top performers keep DAR under 30 days. But many organizations remain far above that benchmark due to:

- Payer slowdowns

- Staffing limitations

- Preventable denials

- Outdated billing workflows

The upside?

With the right strategy, optimized workflows, and modern technology, practices can decrease DAR, accelerate collections, and strengthen their entire healthcare revenue cycle management process.

Understanding Days in Accounts Receivable in Medical Billing

Days in Accounts Receivable (DAR) measures the average number of days it takes a practice or facility to collect payment for services rendered. It reflects the overall health of your revenue cycle:

- High DAR = cash delays, bottlenecks, and inefficiencies

- Low DAR = predictable payments, optimized operations, stronger financial stability

Whether you’re running:

- A primary care practice

- An orthopedic clinic

- A behavioral health center

- A cardiology or neurology group

- A multi-specialty hospital

Reducing DAR is essential to sustainable revenue performance.

Why It Matters for Healthcare Providers and Life Sciences Organizations

- Medicare and Medicaid audits have increased 22% in the last 2 years.

- 70% of claim denials are preventable with proactive AR workflows.

- Patient payments now represent 25–35% of total revenue, meaning uncollected balances accumulate quickly.

Long AR cycles don’t just slow income, they expose practices to compliance risks, write-offs, and payer recoupments.

Leading Causes of High AR Days

Long reimbursement timelines rarely stem from one issue. They usually result from several recurring barriers:

1. Inconsistent claim submission practices

Late, incomplete, or incorrect claims delay payment before the process even starts.

2. Inefficient AR follow-up

Many practices don’t have structured strategies for AR follow-up, allowing balances to age past 90+ days.

3. Lack of real-time eligibility checks

Inaccurate insurance information leads to preventable denials especially in high-turnover insurance states like Florida, Texas, and Ohio.

4. Insufficient denial management workflows

Without clear appeal paths, denials accumulate and remain unresolved.

5. Manual, outdated AR systems

Paper-based workflows or limited practice management tools slow down collections.

6. Poor patient collection processes

Unclear estimates = unpaid balances.

7. Weak staff training on payer rules

Unfamiliarity with coverage limits, medical necessity rules, and prior authorization requirements leads to billing delays.

Impact of Poor AR Management Across Specialties

Specialties hit hardest by elongated AR cycles include:

- Behavioral Health: high patient-responsibility rates

- Cardiology & Orthopedics: costly prior authorizations

- Urgent Care & Emergency Medicine: complex coding patterns

- Neurology & Pain Management: Medicare scrutiny

- Therapy Services: recurring visits = more room for errors

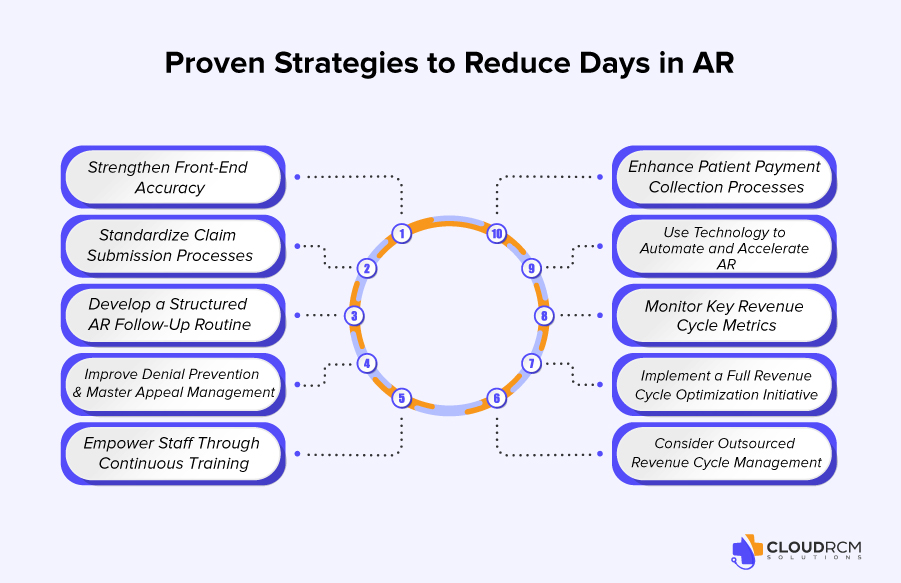

Proven Strategies to Reduce Days in AR

These strategies help practices shorten collection timelines while improving the overall revenue cycle.

1. Strengthen Front-End Accuracy (Eligibility, Coverage, Authorizations)

Accurate intake is the backbone of timely reimbursement.

Essential steps include:

- Real-time eligibility verification

- Capturing secondary insurance

- Confirming deductibles, copays, and coinsurance

- Performing prior authorizations proactively

- Having financial consent forms signed

This alone can reduce denials by 35–40%.

2. Standardize Claim Submission Processes

Creating consistent timelines and checklists ensures claims go out fast and clean:

- Submit claims daily or within 24 hours

- Run scrubbing tools to catch coding issues

- Use electronic claim billing and EFT setups

- Ensure coding aligns with payer-specific rules

Electronic billing reduces DAR by up to 14 days.

3. Develop a Structured AR Follow-Up Routine

Timely, organized outreach prevents revenue from aging out.

Replace “random calling” with a strategic system:

- Follow up at 15, 30, 45, and 60+ days

- Separate AR by payer type

- Use dedicated team members for Medicare, Medicaid, and commercial payers

- Track common payer delays and trends

4. Improve Denial Prevention & Master Appeal Management

A strong denial workflow includes:

- Reviewing denial reasons weekly

- Grouping repeat payer issues

- Re-educating staff on coding and documentation

- Creating templates for appeals

- Maintaining a payer rule library

Efficient denial recovery boosts revenue by 22% on average.

5. Empower Staff Through Continuous Training

Well-trained teams accelerate reimbursement dramatically.

Topics should include:

- Payer/plan variations

- Coordination of benefits

- Medical necessity requirements

- Coding and documentation essentials

- Patient cost estimates

6. Enhance Patient Payment Collection Processes

Patient responsibility has doubled in the last 5 years. To increase collections:

- Provide upfront cost estimates

- Offer multiple payment options

- Train staff on financial conversations

- Use automated reminders

- Send digital statements and text reminders

- Offer payment plans

Practices that display transparent pricing see 20–30% higher payment rates.

7. Use Technology to Automate and Accelerate AR

Modern revenue cycle tools help reduce manual workload:

- AR analytics dashboards

- Automated claim scrubbing

- Eligibility verification systems

- Robotic process automation (RPA)

- Patient payment portals

Automation alone can reduce DAR by 15–25%.

8. Monitor Key Revenue Cycle Metrics

Track metrics like:

- DAR (primary KPI)

- AR >90 days

- Clean Claim Rate

- First-Pass Resolution Rate

- Denial percentage by payer

- Patient collection rate

Consistent tracking allows rapid correction when performance declines.

9. Implement a Full Revenue Cycle Optimization Initiative

Organizations ready to take a bigger step should:

- Map the entire workflow

- Identify bottlenecks

- Update SOPs

- Restructure payer follow-up tasks

- Strengthen cross-department communication

Even small changes can shorten reimbursement timelines dramatically.

10. Consider Outsourced Revenue Cycle Management

Practices struggling with staffing, denials, or inconsistent follow-up often turn to outsourced RCM solutions for:

- Professional AR recovery

- Faster turnaround times

- Experienced denial specialists

- Automation tools

- Full visibility into performance metrics

This is where Cloud RCM Solutions becomes a powerful partner.

How Cloud RCM Solutions Helps Reduce Days in AR

Cloud RCM Solutions supports practices by:

- Strengthening front-end accuracy

- Enhancing claim submission workflows

- Streamlining denial management

- Providing specialty-trained AR teams

- Leveraging analytics and automation

- Offering complete transparency into financial KPIs

Conclusion: Reducing DAR Isn’t Optional — It’s a Strategic Advantage

In a healthcare landscape with rising claim denials, increasing patient balances, and heightened payer scrutiny, reducing Days in Accounts Receivable is one of the most effective ways to maintain financial stability.

With smarter workflows, better technology, and expert support, practices can unlock:

- Faster cash flow

- Stronger financial health

- Reduced write-offs

- Happier staff and patients

Cloud RCM Solutions is here to help without overpromising or oversimplifying. Our methodologies are proven, compliant, and customized for every specialty.

FAQS

What does Days in Accounts Receivable (DAR) mean in medical billing?

Days in Accounts Receivable (DAR) represent the average number of days it takes for a medical practice or facility to collect payment after services are provided. It is a key metric for evaluating financial performance and the overall effectiveness of your healthcare revenue cycle management.

What is a good benchmark for Days in AR in healthcare?

Industry reports show that high-performing medical practices maintain DAR between 25–35 days, while many organizations fall between 40–60 days. Lower DAR typically indicates strong billing, efficient AR follow-up strategies, and optimized collections.

How do aging reports help improve AR performance?

Aging reports classify outstanding claims by time periods (0–30, 31–60, 61–90, 120+ days). Reviewing these reports helps practices identify problem areas, track payer delays, and improve medical billing collections.

Can technology help reduce Days in Accounts Receivable?

Yes. Tools like automated claim scrubbing, RPA bots, eligibility software, and AR dashboards help streamline workflows, prevent errors, and accelerate reimbursement. Technology is one of the fastest ways to reduce Days in Accounts Receivable.

How long does it take to see results after improving AR workflows?

Many practices see measurable improvements in DAR and cash flow within 30–90 days, depending on claim volume, payer mix, and the current state of their revenue cycle.

What is the financial impact of reducing DAR by even a few days?

Every one-day reduction in DAR can free up tens of thousands of dollars in working capital for medium-sized practices and significantly more for hospital systems. Faster payments improve operational stability and reduce reliance on credit.

Can reducing DAR help prevent write-offs?

Absolutely. Shorter AR cycles reduce the number of claims that age into the 120+ day category, where write-off risk is highest. Better workflows = fewer lost dollars.

Medical Billing

Medical Billing Medical Coding

Medical Coding Medical Audit

Medical Audit Provider Credentialing

Provider Credentialing Denial Management

Denial Management A/R Follow-up

A/R Follow-up Private Practice

Private Practice Patient Help Desk

Patient Help Desk Customized Reporting

Customized Reporting Out-of-Network Billing

Out-of-Network Billing Internal Medicine

Internal Medicine Pediatrics

Pediatrics Radiology

Radiology Surgery

Surgery Emergency Medicine

Emergency Medicine Anesthesiology

Anesthesiology Cardiology

Cardiology Orthopedic

Orthopedic Psychiatry

Psychiatry Dentistry

Dentistry OB-GYN

OB-GYN Family Medicine

Family Medicine